Top 5 Stocks in February: Leaders of Growth and Decline

9 minutes for reading

NeoGenomics Inc., Frontline PLC, Hims & Hers Health Inc., Luminar Technologies Inc., and e.l.f. Beauty Inc. were among the top five companies that saw the biggest stock gains in February. Meanwhile, the leaders of stock decline were Wayfair Inc., Xp Inc., Match Group Inc., Chegg Inc., and Lucid Group Inc.

Selection criteria

- The stock is traded on the NYSE or NASDAQ

- The share price exceeds $2

- The companies are not funds

- Their capitalisation is more than $2 billion

- The average trade volume of the last 30 days is more than 750,000 shares

Growth and decline values were determined as the percentage difference between the closing prices of 31 January and 28 February 2023. The market capitalisation of the companies was valid for the time when the article was being written.

Stocks with the most prominent growth in February

1. NeoGenomics: +41.84%

Founded in: 2001

Registered in: the US

Head office: Fort Myers, Florida

Sector: healthcare

Platform: NASDAQ

Market capitalisation: $2.15 billion

NeoGenomics Inc. specialises in genetic tests that help detect, diagnose, and treat cancer. The corporation partners with medical institutions, pharmaceutical, biotechnology, and research companies to provide a broad range of innovative and highly effective testing methods.

Over February 2023, the stock price of NeoGenomics Inc. (NASDAQ: NEO) recorded a 41.84% rise from $11.88 to $16.85. On 23 February, the company reported fourth-quarter and full-year earnings. Compared to the statistics of Q4 2021, revenue for October to December 2022 increased by 10.32% to $138.71 million, the net loss dropped by 45.67% to $22.69 million, and the loss per share decreased by 47.06% to $0.18. Annual revenue reached $509.73 million, net loss reached $144.25 million, and loss per share reached $1.16.

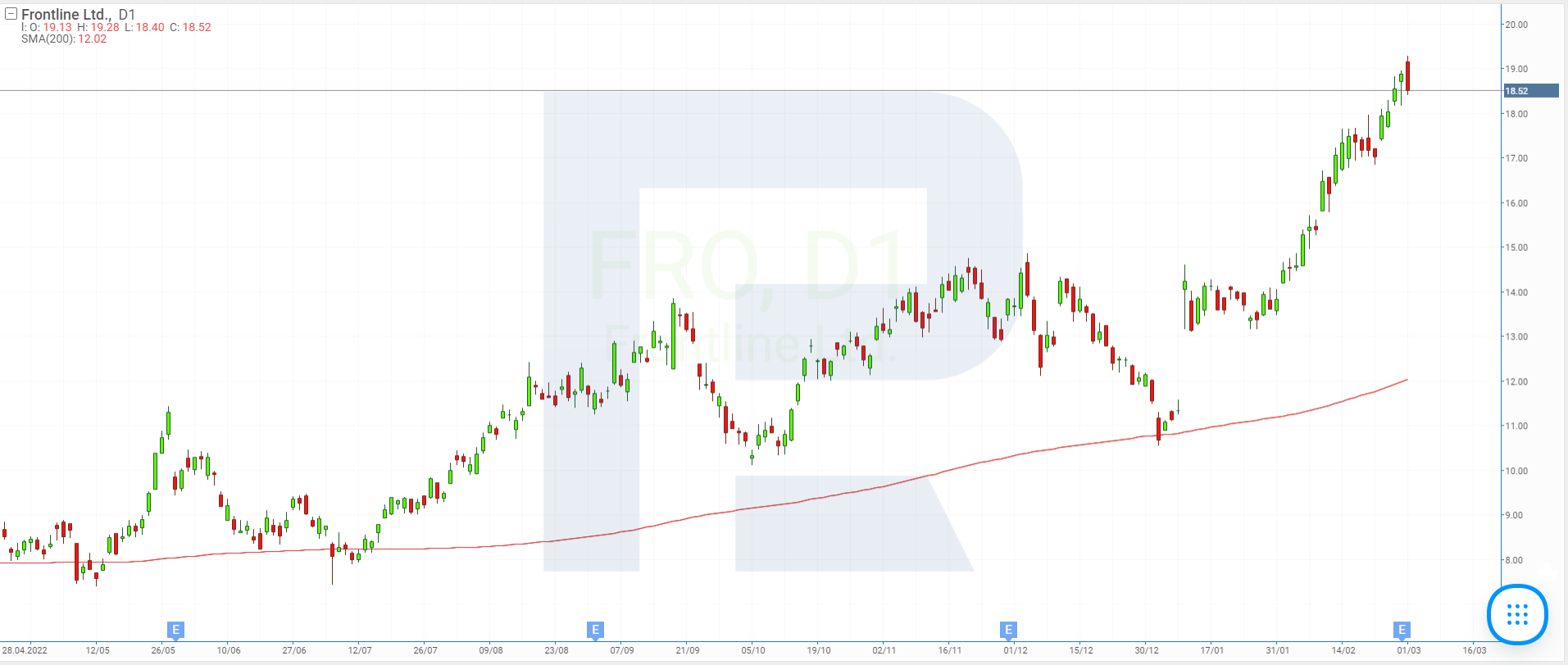

2. Frontline: +36.59%

Founded in: 1985

Registered in: Bermuda

Head office: Hamilton

Sector: energy

Platform: NYSE

Market capitalisation: $4.18 billion

Frontline PLC is a shipping company that delivers crude oil and oil products by sea worldwide. Moreover, a part of its business is chartering and trading ships. Over the last month, the shares of Frontline PLC (NYSE: FRO) recorded a 36.59% growth from $13.83 to $18.89.

On 28 February, Frontline PLC shared the results of Q4 2022. Operating revenue increased by 148.3% to $530.1 million, exceeding the consensus forecast of $365 million. Net profit reached $240 million, or $1.08 per share, which is a record since Q2 2008. Moreover, Frontline PLC announced dividend payments for Q3 and Q4 of $0.3 and $0.77 per share, respectively.

3. Hims & Hers Health: +36.11%

Founded in: 2017

Registered in: the US

Head office: San Francisco, California

Sector: consumer defensive

Platform: NYSE

Market capitalisation: $2.35 billion

Hims & Hers Health Inc. manufactures and sells prescription and over-the-counter medicines, cosmetics, and personal hygiene items. Its activities are related to telemedicine. During the period of interest, Hims & Hers Health Inc. (NYSE: HIMS) shares recorded a 36.11% growth from $8.28 to $11.27.

On 27 February, the company reported impressive results for Q4 and the whole of 2022. In the period from October to December, revenue increased by 97.4% to $167.2 million, the net loss dropped by 65% to $10.91 million, and the loss per share by 66.67% to $0.05. Over the year, revenue recorded a growth of 93.81% to $526.92 million, the net loss dropped by 39% to $65.68 million, and the loss per share by 44.83% to $0.32.

4. Luminar Technologies: +34.18%

Founded in: 2012

Registered in: the US

Head office: Orlando, Florida

Sector: producer manufacturing

Platform: NASDAQ

Market capitalisation: $3.25 billion

Luminar Technologies Inc. develops innovative safety and autopilot systems based on LiDAR technology, as well as software and hardware for the car industry. Luminar Technologies Inc. (NASDAQ: LAZR) stock gained 34.18% during February, rising from $6.67 to $8.95 per unit.

On 22 February, Luminar Technologies Inc. announced a significant expansion of the terms of its partnership with Mercedes-Benz Group AG, which began last January. While the actual amount of the deal was not disclosed, the company mentioned the “multi-billion dollar” partnership in an official press release.

On February 28, Luminar Technologies Inc. released its fourth-quarter and full-year earnings report. Quarterly revenue sagged by 9.87% to $11.12 million, net loss rose by 95.98% to $144.82 million, and loss per share by 90.48% to $0.4. At the same time, the annual revenue increased by 27.41% to $40.7 million, the net loss rose by 87.38% to $445.94 million, and the loss per share increased by 81.16% to $1.25.

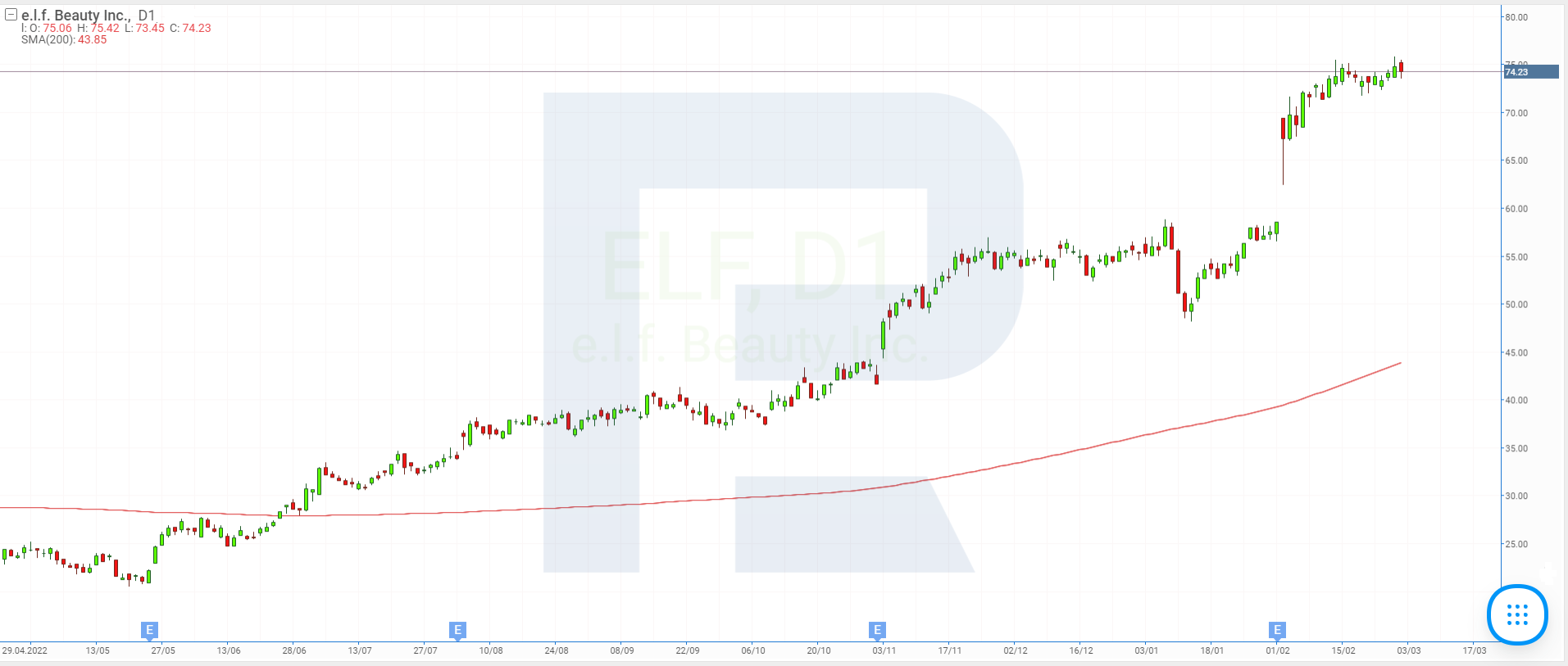

5. e.l.f. Beauty: +29.89%

Founded in: 2004

Registered in: the US

Head office: Oakland, California

Sector: consumer non-durables

Platform: NYSE

Market capitalisation: $3.98 billion

e.l.f. Beauty Inc. develops, produces, and sells cosmetics and skin care products. The company’s products are manufactured and marketed under various brands, such as elf Cosmetics, elf Skin, Well People, and Keys Soulcare. During last month, the stock price of e.l.f. Beauty Inc. (NYSE: ELF) gained 29.89%, rising from $57.55 to $74.75.

On 2 February, e.l.f. Beauty Inc. presented its report for the third quarter of fiscal 2023. The company reported October to December numbers increased as follows: revenue up by 49.35% to $146.54 million, net profit up by 207.45% to $19.11 million, and EPS up by 183.33% to $0.34. Moreover, the management of the company raised its revenue forecast for the full fiscal year 2023 from $478-486 million to $541-545 million.

Stocks with the most prominent decline in February

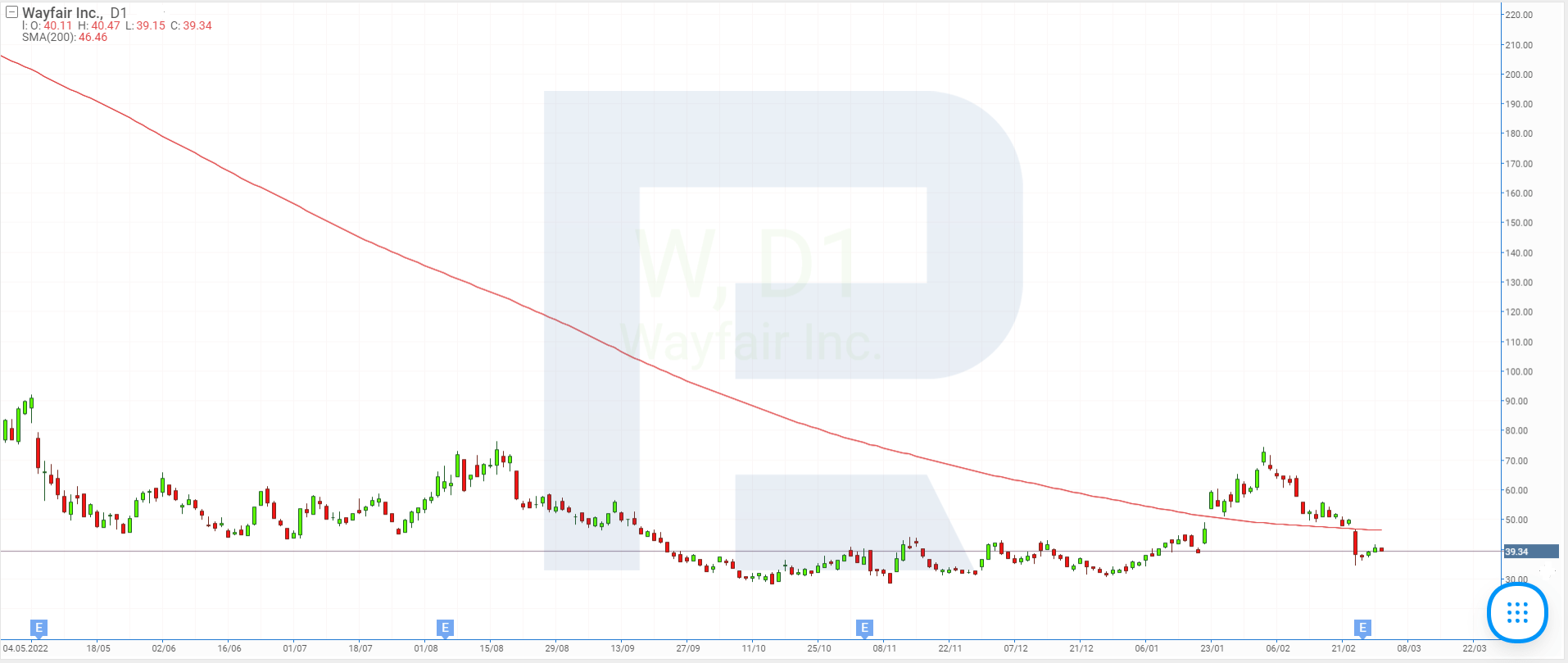

1. Wayfair: -33.07%

Founded in: 2002

Registered in: the US

Head office: Boston, Massachusetts

Sector: retail trade

Platform: NYSE

Market capitalisation: $4.48 billion

Wayfair Inc. is one of the world’s largest online retailers of home goods. The company offers more than 33 million items from more than 23 thousand suppliers under the brands Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold.

As you might recall, in January the corporation was featured on the Top 5 list of stock price gains.

In February, Wayfair Inc. (NYSE: W) quotes dropped by 33.07% from $60.5 to $40.49. On 23 February, the company reported its final quarter and full-year earnings. Revenue for the period from October to December fell 4.64% to $3.1 billion, net loss increased by 73.76% to $351 million, and loss per share rose 69.79% to $3.26. Annual revenue fell 10.87% to $12.22 billion, and net loss increased by 916.04% to $1.33 billion or $12.54 per share.

2. Xp: -30.3%

Founded in: 2001

Registered in: Brazil

Head office: San Paulo

Sector: financial services

Platform: NASDAQ

Market capitalisation: $6.96 billion

XP Inc. provides a wide range of financial products and services in Brazil. The corporation owns a brokerage company, a digital investment platform, news, information, and educational resources. Last month, the stock price of XP Inc. (NASDAQ: XP) fell 30.3% from $17.82 to $12.42.

On 16 February, the company published its quarterly and yearly reports. Revenues for the fourth quarter fell 3% to R$3.18 billion (Brazilian real), net profit decreased 21% to R$783 million, and EPS fell 19% to R$1.39. Revenue for the full year 2022 increased 11% to R$13.35 billion, while net profit remained flat at R$3.58 billion or R$6.25 per share.

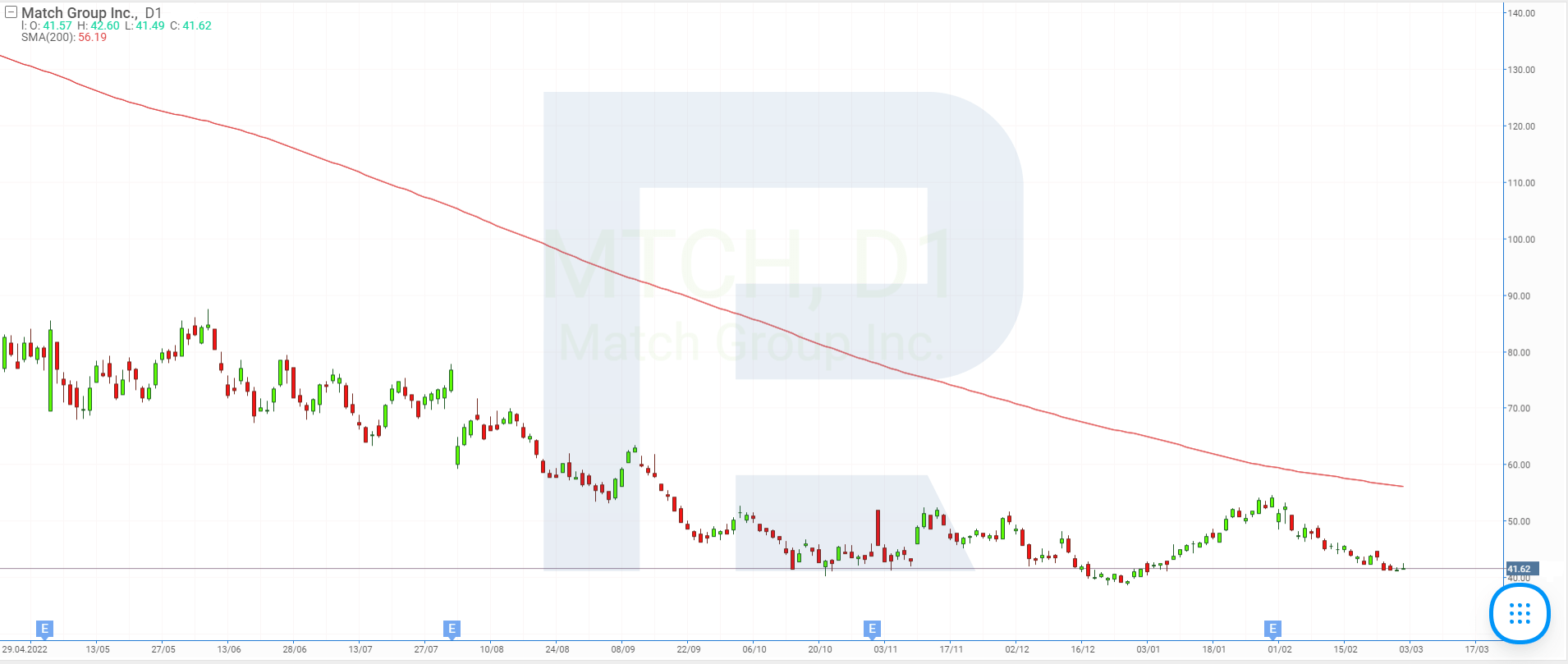

3. Match Group: -23.47%

Founded in: 1986

Registered in: the US

Head office: Dallas, Texas

Sector: tech services

Platform: NASDAQ

Market capitalisation: $11.57 billion

Match Group Inc. is one of the largest representatives of the online dating market. The company owns Tinder, Match, The League, Azar, Meetic, OkCupid, Hinge, Pairs, Plenty of Fish, Hakuna, and other popular products. Match Group Inc (NASDAQ: MTCH) was down 23.47% in February, from $54.12 to $41.42.

On 1 February, the corporation released results for the fourth quarter and full year of 2022 – Wall Street analysts had expected a higher rate of growth in its financial performance. Quarterly revenue fell 2.47% to $786.15 million, a net loss was replaced by a profit of $83.41 million, or $0.3 per share. For the year, revenue rose 6.87% to $3.19 billion, net profit increased 30.14% to $359.92 million, and earnings per share rose 34.41% to $1.25.

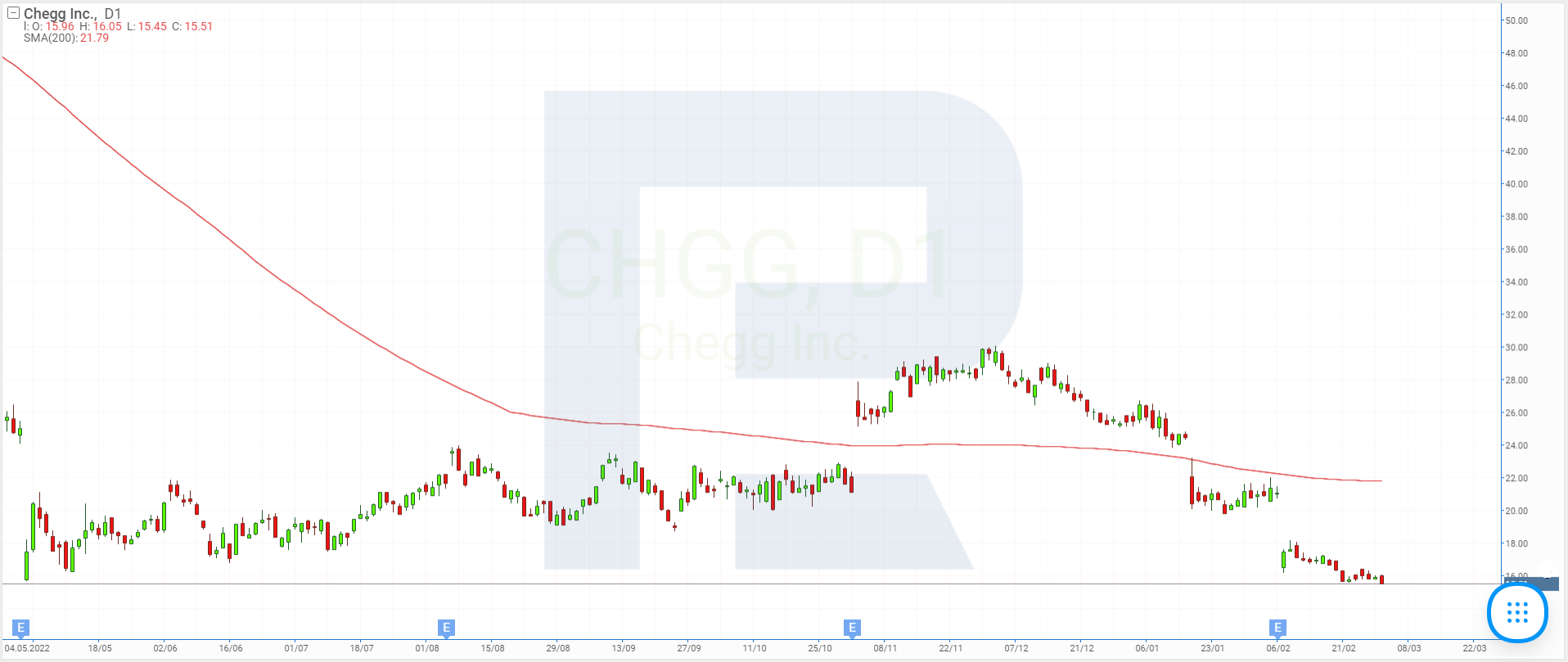

4. Chegg: -23.46%

Founded in: 2005

Registered in: the US

Head office: Santa Clara, California

Sector: commercial services

Platform: NYSE

Market capitalisation: $2.01 billion

Chegg Inc. is an education company that provides a wide range of services for students. Through its online resources, customers can find a tutor, rent, or buy learning materials, both digital and paper, and get all the information and help they need to learn.

In February, the stock price of Chegg Inc. (NYSE: CHGG) dropped by 23.46% from $20.76 to $15.89 per unit. According to the report published on 6 February, fourth-quarter revenue fell 1.1% to $205.19 million, net profit was down 92.36% to $1.86 million, and EPS was up 93.33% to $0.01. Revenue for 2022 amounted to $766.9 million, net profit was $266.64 million, and EPS was $1.34.

5. Lucid Group: -21.9%

Founded in: 2007

Registered in: the US

Head office: Newark, California

Sector: consumer durables

Platform: NASDAQ

Market capitalisation: $16.69 billion

Electric car maker Lucid Group Inc. (NASDAQ: LCID) saw its stock price drop 21.9% in February, from $11.69 to $9.13 per unit. On 2 February, the company released its fourth-quarter and full-year 2022 report.

Lucid Group Inc.'s quarterly revenue increased 876.48% to $257.71 million, net loss decreased 54.79% to $472.65 million, and loss per share decreased 56.25% to $0.28. Annual revenue rose 2,143.29% to $608.18 million, net loss slipped 49.43% to $1.3 billion, and loss per share declined 76.44% to $1.51. Meanwhile, the consensus revenue forecast was $302.61 million for the quarter and $661 million for the year.

For 2022, Lucid Group Inc. produced 7,180 electric cars, up from its own forecast of 6,000-7,000 cars. The company says there is a noticeable decline in demand and therefore expects to produce between 10,000 and 14,000 electric vehicles in 2023. This is significantly less than analysts' forecasts, which had anticipated the figure to reach 20,000-22,000 electric cars.

Which stocks demonstrated the most prominent dynamics in February?

The leaders of stock price gains in February were NeoGenomics Inc., Frontline PLC, Hims & Hers Health Inc., Luminar Technologies Inc., and e.l.f. Beauty Inc. The most noticeable decline, on the other hand, was noticed in the stock of Wayfair Inc., Xp Inc., Match Group Inc., Chegg Inc., and Lucid Group Inc. For the most part, the growth and decline of the shares of the participants in the February top above were triggered by their quarterly and annual report results.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high