Top 5 Stocks in April: Leaders of Growth and Decline

8 minutes for reading

Prometheus Biosciences Inc., TG Therapeutics Inc., Arrowhead Pharmaceuticals Inc., StoneCo Ltd., and IVERIC bio Inc. were among the top five companies that saw the biggest stock gains in April. Meanwhile, the leaders of stock decline last month were C3.ai Inc., Wolfspeed Inc., Allegro MicroSystems Inc., PBF Energy Inc., and CVR Energy Inc.

Selection criteria

- The stock is traded on the NYSE and NASDAQ

- The share price exceeds 2 USD

- The companies are not funds

- The capitalisation is over 2 billion USD

- The average trade volume of the last 30 days is more than 750,000 shares

Growth and decline values were determined as the percentage difference between the opening price of 3 April and the closing price of 28 April 2023. The market capitalisation of the companies was valid as of the time of writing.

Stocks with the most significant gains in April

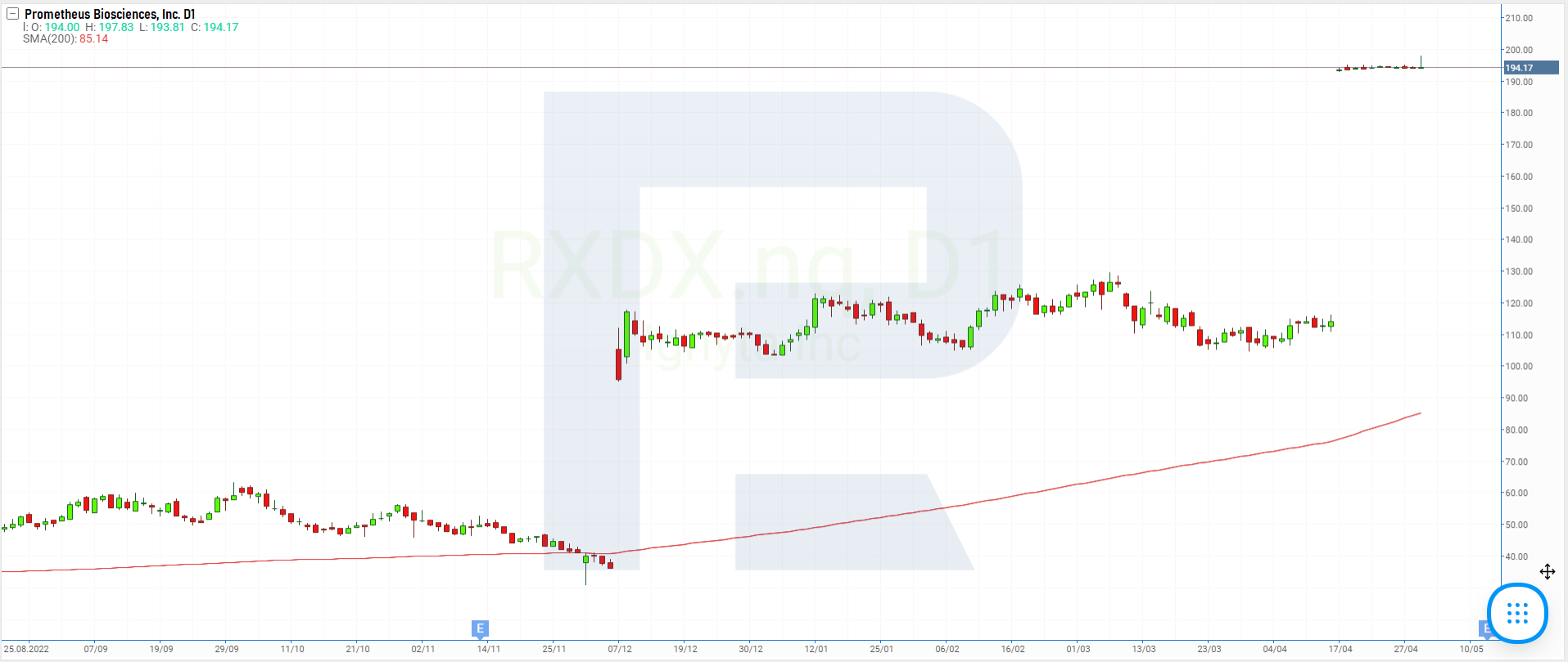

1. Prometheus Biosciences: +82.37%

Founded in: 2016

Registered in: the US

Headquarters: San Diego, California

Sector: healthcare

Platform: NASDAQ

Market capitalisation: 9.28 billion USD

Prometheus Biosciences Inc. is a clinical-stage biotechnology company, specialising in developing therapies for the treatment of inflammatory bowel diseases and other autoimmune diseases. Until 2019, the company’s name was Precision IBD Inc. Prometheus Biosciences Inc.

Prometheus Biosciences Inc. (NASDAQ: RXDX) shares surged 82.37% from 106.35 USD to 193.95 USD per unit in April. It was revealed on 16 April that one of the world’s largest pharmaceutical corporations, Merck & Company Inc. (NYSE: MRK), would buy this biotechnology company for 10.8 billion USD.

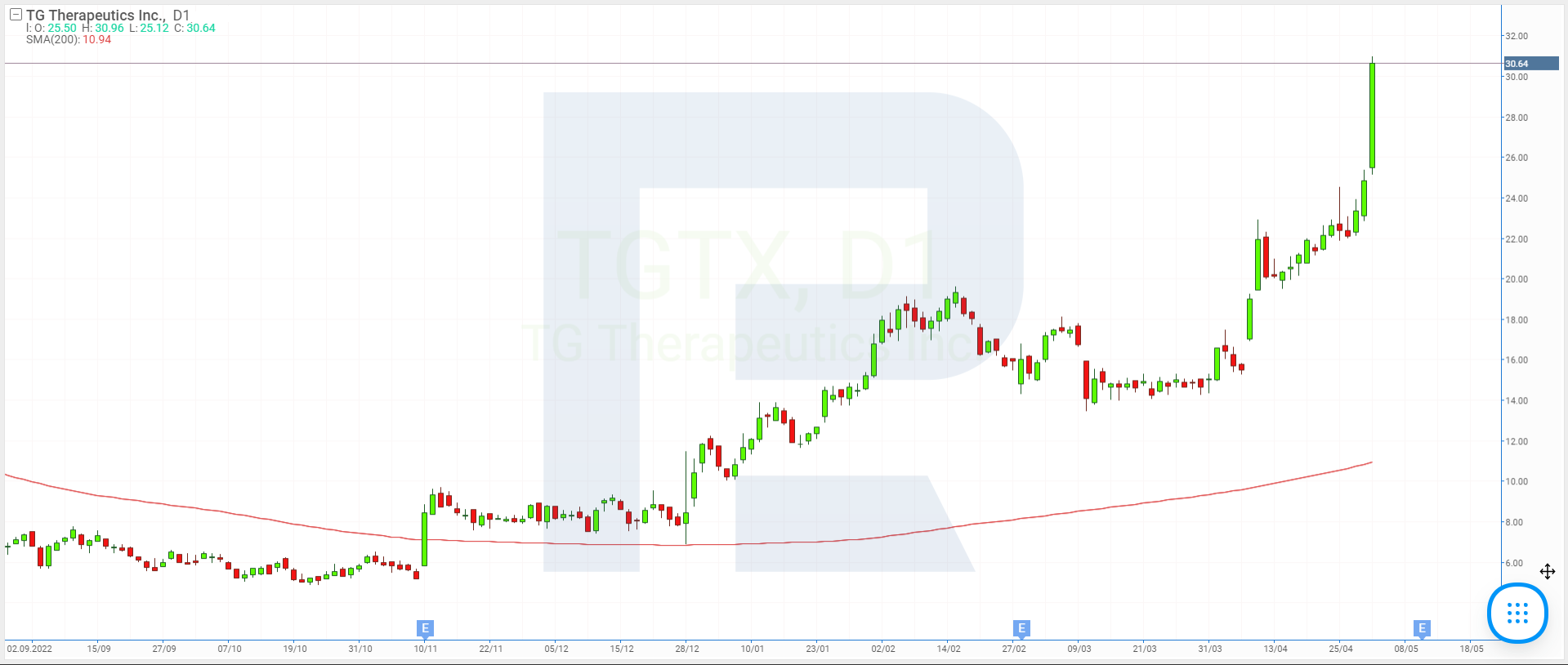

2. TG Therapeutics: +65.42%

Founded in: 1993

Registered in: the US

Headquarters: Morrisville, North Caroline

Sector: healthcare

Platform: NASDAQ

Market capitalisation: 4.21 billion USD

TG Therapeutics Inc. is a biopharmaceutical company engaged in the purchase, development, and commercialisation of new medicines for the treatment of B-cell diseases. TG Therapeutics Inc. (NASDAQ: TGTX) shares increased 65.42% from 15.01 USD to 24.83 USD per unit over the past month.

Cantor Fitzgerald analyst Prakhar Agrawal assumed on 9 April that the Q1 2023 sales volume of Briumvi developed by TG Therapeutics Inc. could exceed market players’ expectations and reach 3.3. million USD.

Recall that Briumvi is a medicine for the treatment of multiple sclerosis. It was approved by the US Food and Drug Administration (FDA) in December 2022. The European regulatory authority is also expected to authorise the use of this medicine for the treatment of multiple sclerosis in adults in the short run.

3. Arrowhead Pharmaceuticals: +39.52%

Founded in: 1989

Registered in: the US

Headquarters: Pasadena, Califonia

Sector: healthcare

Platform: NASDAQ

Market capitalisation: 3.82 billion USD

Arrowhead Pharmaceuticals Inc. develops innovative medicines to treat intractable diseases. Based on the previous month’s results, Arrowhead Pharmaceuticals Inc. (NASDAQ: ARWR) quotes rose 39.52% from 25.38 USD to 35.41 USD.

On 3 April, the company announced that it had received a 30 million USD payment from GSK plc (NYSE: GSK) for investigating ARO-HSD (GSK4532990), which was followed by phase 2 trial of this therapeutic for the treatment of non-alcoholic steatohepatitis.

On 4 April, it was announced that a 40 million USD payment was received from Takeda Pharmaceutical Co. Ltd. (NYSE: TAK) for the trial of fazirsiran, and phase 3 trial of this medication for the treatment of liver diseases started.

On 25 April, Arrowhead Pharmaceuticals Inc. informed of positive interim trial results for ARO-RAGE, a therapeutic for the treatment of inflammatory diseases, including asthma.

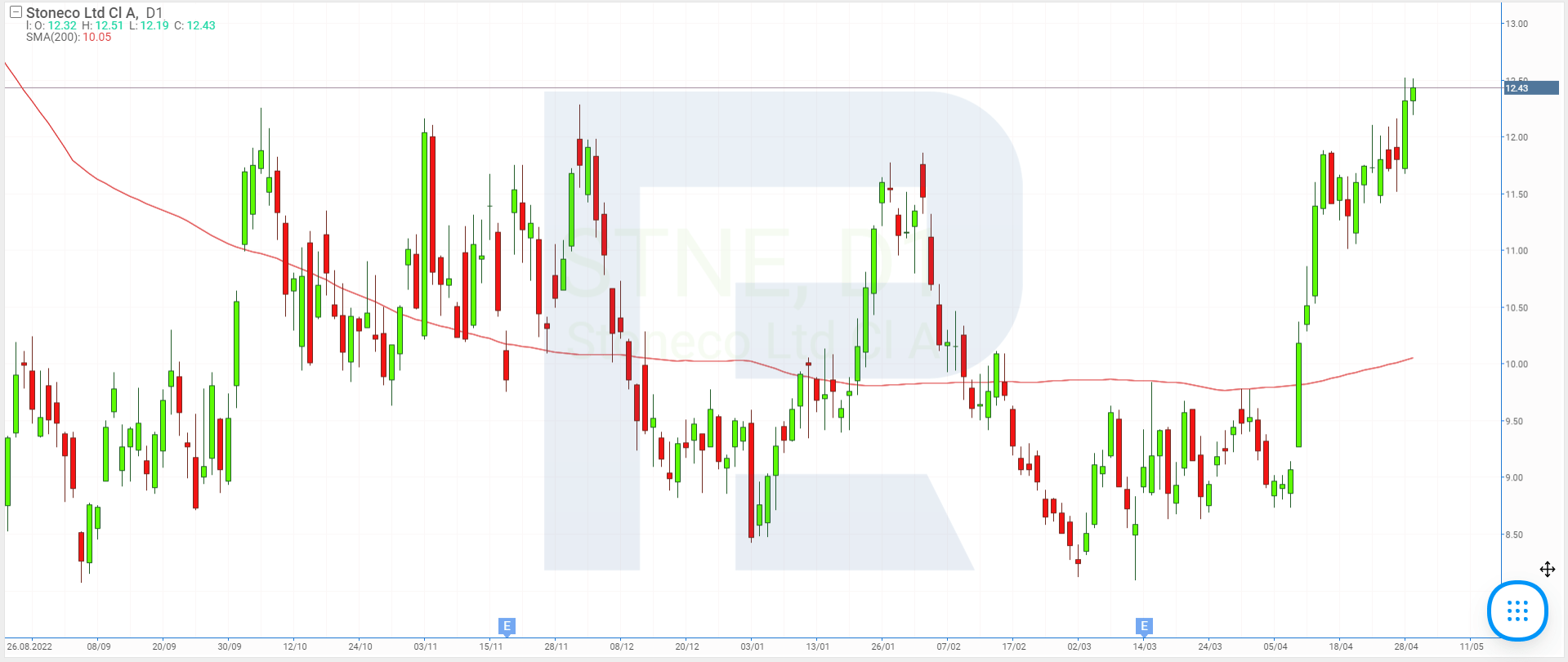

4. StoneCo: +29.68%

Founded in: 2000

Registered in: the Cayman Islands

Headquarters: George Town

Sector: technology

Platform: NASDAQ

Market capitalisation: 3.73 billion USD

StoneCo Ltd. develops sofware solutions for e-commerce and provides financial services. The main market of the company is Brazil. StoneCo Ltd. (NASDAQ: STNE) stock added 29.68% from 9.5 USD to 12.32 USD per unit in April. It is difficult to identify any event that could explain this growth.

5. IVERIC bio: +24.35%

Founded in: 2007

Registered in: the US

Sector: healthcare

Headquarters: Parsippany, New Jersey

Platform: NASDAQ

Market capitalisation: 5.13 billion USD

IVERIC bio Inc., which was known as Ophthotech Corporation until 2019, is a biopharmaceutical company focused on developing new treatments for a wide range of retinal diseases. Last month, IVERIC bio Inc. (NASDAQ: ISEE) stock saw an increase of 24.35% from 26.45 USD to 32.89 USD per share. On 30 April, the company announced it was being acquired by Japanese pharmaceutical corporation Astellas Pharma Inc. for 5.9 billion USD.

Stocks with the most prominent declines in April

1. C3.ai: −47.31%

Founded in: 2009

Registered in: the US

Headquarters: Redwood City, California

Sector: technology

Platform: NYSE

Market capitalisation: 2.06 billion USD

C3.ai Inc. develops software for creating AI-based applications and corporate products. The company was on our Top 5 Stocks lists in January and March 2023. In April, C3.ai Inc. (NYSE: AI) quotes declined 47.31% from 33.82 USD to 17.82 USD.

In early April, Kerrisdale Capital investment company announced that C3.ai Inc. was fraudulently manipulating its financial statements. And in late April, Wolfe Research analyst Joshua Tilton downgraded the rating of the technology corporation’s stock from “Hold” to “Sell” and lowered its target price to 14 USD per unit.

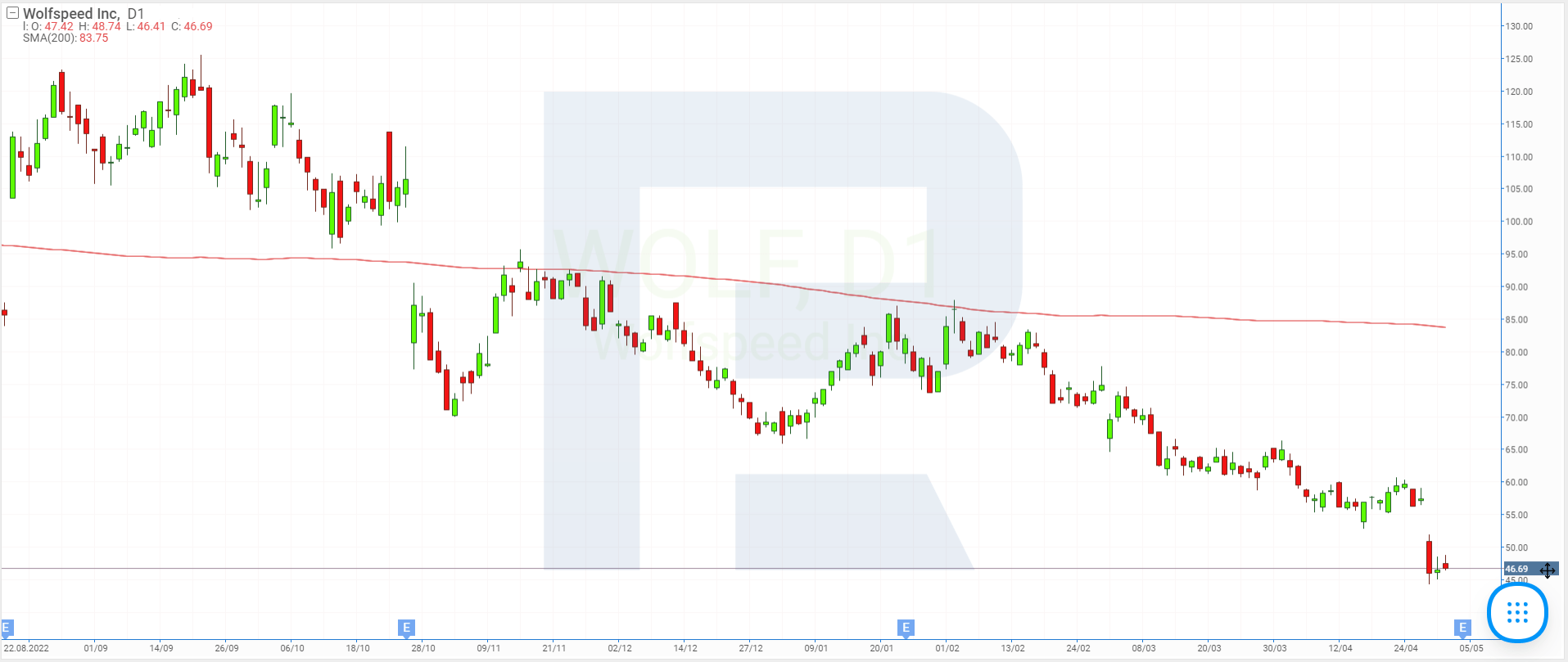

2. Wolfspeed: −26.37%

Founded in: 1987

Registered in: the US

Headquarters: Durham, North Caroline

Sector: technology

Platform: NYSE

Market capitalisation: 5.74 billion USD

Wolfspeed Inc., which was called Cree Inc. until 2021, develops, manufactures, and sells conductor products. Its focus is on silicon carbide and gallium nitride products. Wolfspeed Inc. (NYSE: WOLF) stock dropped 26.37% from 63.22 USD to 46.55 USD per share last month.

According to the company’s results for the third quarter of fiscal 2023, which were released on 26 April, revenue recorded a 21.65% increase, growing to 228.7 million USD compared to the statistics for the same period in fiscal 2022. Net loss increased by 49.62% to 99.5 million USD or 0.8 USD per share.

Wolfspeed Inc. also reported difficulties in ramping up the production of silicon carbide. It is more expensive and difficult to produce than traditional silicon but has high electrical conductivity and heat resistance, as well as durability. It is one of the most advanced materials for chip production.

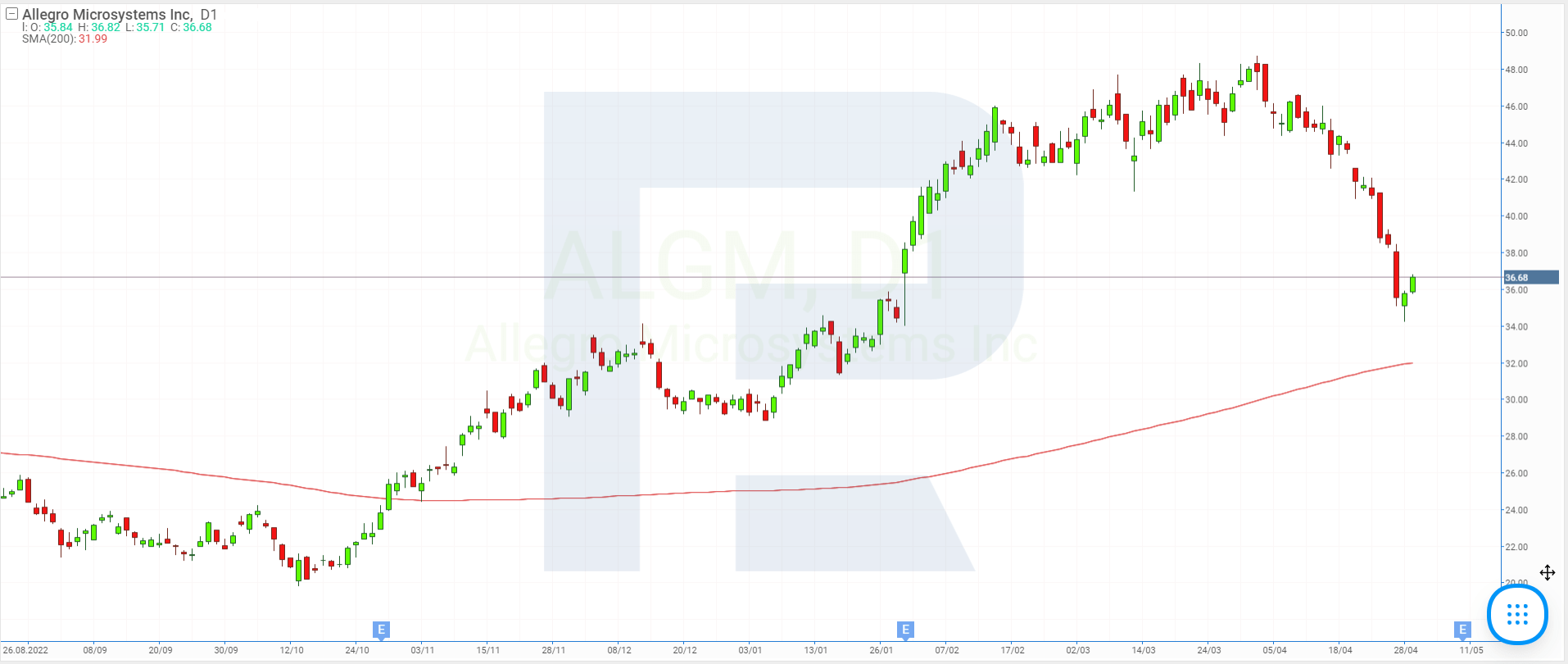

3. Allegro MicroSystems: −25.86%

Founded in: 1990

Registered in: the US

Headquarters: Manchester, New Hampshire

Sector: technology

Platform: NASDAQ

Market capitalisation: 6.99 billion USD

Allegro MicroSystems Inc. engages in the development, manufacturing, and sale of semiconductor products. The company specialises in the production of integrated circuits for the automotive industry. During the period of interest, Allegro MicroSystems Inc. (NASDAQ: ALGM) lost 25.86% from 48.25 USD to 35.77 USD per share. It can be assumed that the company’s quotes were negatively affected by a statement made by Wolfspeed Inc.’s management about difficulties in silicon carbide production.

4. PBF Energy: −23.04%

Founded in: 2008

Registered in: the US

Headquarters: Parsippany, New Jersey

Sector: energy

Platform: NYSE

Market capitalisation: 4.47 billion USD

PBF Energy Inc. is an independent petroleum refiner and supplier of petrochemicals, transportation fuels, lubricants, heating oil, and other petroleum products. The company’s products are sold in the US, Canada, and Mexico.

Based on April results, PBF Energy Inc. (NYSE: PBF) stock tumbled 23.04% from 45.3 USD to 34.86 USD per share. It is difficult to identify any event that could explain such a decline.

5. CVR Energy: −22.12%

Founded in: 1906

Registered in: the US

Headquarters: Sugar Land, Texas

Sector: energy

Platform: NYSE

Market capitalisation: 2.67 billion USD

CVR Energy Inc. specialises in crude oil refining and nitrogen fertilizer production. The corporation processes and sells petrol, diesel fuel, and other petroleum products. CVR Energy Inc. (NYSE: CVI) quotes dropped 22.12% from 33.82 USD to 26.34 USD over the past month. It is difficult to identify any event that could explain such a decline.

Stocks with the most prominent dynamics in April

The leaders of stock price gains in April were Prometheus Biosciences Inc., TG Therapeutics Inc., Arrowhead Pharmaceuticals Inc., StoneCo Ltd., and IVERIC bio Inc. Four out of these five companies represent the healthcare sector. In most cases, the stock growth was fuelled by news about the sale of a company and the release of positive trial results for new medicines.

C3.ai Inc., Wolfspeed Inc., Allegro MicroSystems Inc., PBF Energy Inc., and CVR Energy Inc. saw the biggest decline in their stocks last month. Most companies on this list are from the technology sector. The quotes of the companies involved in the manufacturing of semiconductor products were negatively affected by the news about difficulties in silicon carbide production.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high