Top 5 Stocks in March: Leaders of Growth and Decline

8 minutes for reading

Reata Pharmaceuticals Inc., Enovix Corporation, Duolingo Inc., C3.ai Inc., and LifeStance Health Group Inc. were among the top five companies that saw the biggest stock gains in March. Meanwhile, the leaders of stock decline last month were First Republic Bank, ProFrac Holding Corp., KeyCorp, Bank of Hawaii Corporation, and CVB Financial Corp.

Selection criteria

- The stock is traded on the NYSE or NASDAQ

- The share price exceeds $2

- The companies are not funds

- Their capitalisation is more than $2 billion

- The average trade volume of the last 30 days is more than 750,000 shares

Growth and decline values were determined as the percentage difference between the closing prices of 28 February and 31 March 2023. The market capitalisation of the companies was valid at the time of writing.

Stocks with the most significant gains in March

1. Reate Pharmaceuticals: +191.69%

Founded in: 2002

Registered in: the US

Head office: Plano, Texas

Sector: healthcare

Platform: NASDAQ

Market capitalisation: $3.31 billion

Reata Pharmaceuticals Inc. is a biopharmaceutical company that specialises in developing and commercialising new treatment methods for patients with serious neurological diseases and chronic kidney conditions. Over March, the stock price of Reata Pharmaceuticals Inc. (NASDAQ: RETA) skyrocketed 191.69% from $31.17 to $90.92 per unit.

On 28 February, the company announced that the US Food and Drug Administration (FDA) approved the SKYCLARYS (omaveloxolone) drug for treating Friedreich ataxia in adults and adolescents aged 16 years and older.

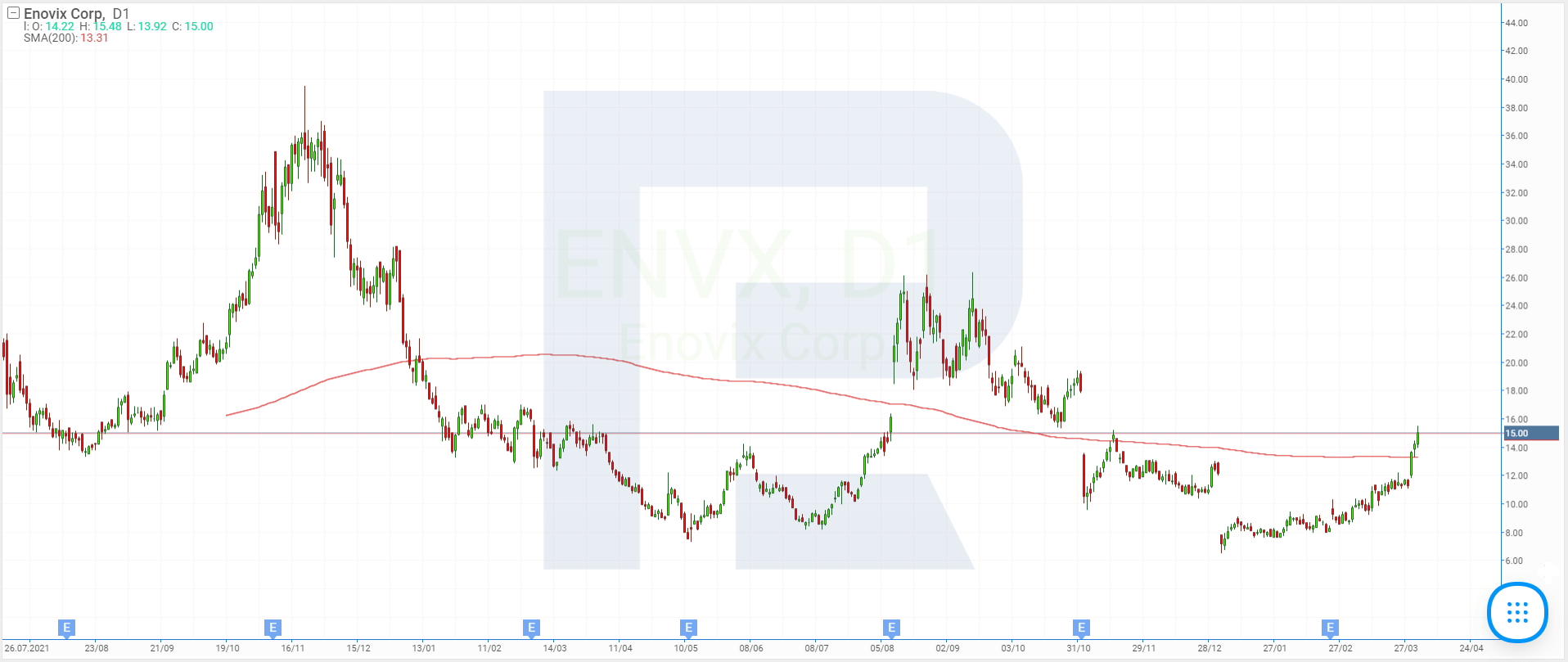

2. Enovix: +61.71%

Founded in: 2007

Registered in: the US

Head office: Fremont, California

Sector: electrical equipment

Platform: NASDAQ

Market capitalisation: $2.24 billion

Enovix Corporation designs, develops, and produces lithium-ion and silicon accumulators of a new generation. It was featured in our ratings “Top 5 Stocks in July 2022” and “Top 5 Stocks in August 2022”. Over the last month, Enovix Corporation (NASDAQ: ENVX) shares saw an increase of 61.71% from $9.22 to $14.91 per unit.

Important personnel changes in the company were announced on 13 March: Samira Naraghi took over the post of product management vice president; Milind Patil became the global purchasing vice president; and Mani Balasubramanian was appointed control vice president.

On 29 March, Enovix Corporation announced its partnership with YBS International Berhad and that it would move its large Fab-2 plant to Penang, Malaysia. As you may recall, YBS International Berhad is a Malaysian investment company that finances projects specialising in high-precision design, production, and assembly of electronics.

3. Duolingo: +57.06%

Founded in: 2011

Registered in: the US

Head office: Pittsburgh, Pennsylvania

Sector: technology

Platform: NASDAQ

Market capitalisation: $5.53 billion

Duolingo Inc. is a technology company that develops and monetises the Duolingo online platform, which enables studying more than 40 foreign languages. Over the last month, Duolingo Inc. (NASDAQ: DUOL) shares recorded a 57.06% increase from $90.79 to $142.59 per unit.

On 28 February, the corporation reported its performance in the fourth quarter and full year of 2022. In the period from October to December, revenue increased by 42.19% to $103.82 million from the figure of the same period in 2021, and the net loss dropped by 20.57% to $13.93 million. As for the annual revenue, it increased by 47.34% to $369.5 million compared to that of 2021, while the net loss saw a decrease of 0.94% to $59.57 million.

Over the fourth quarter, the number of daily active users grew by 62% to 16.3 million people, the number of monthly active users increased by 43% to 60.7 million, and the number of paid subscribers by 67% to 4.4 million.

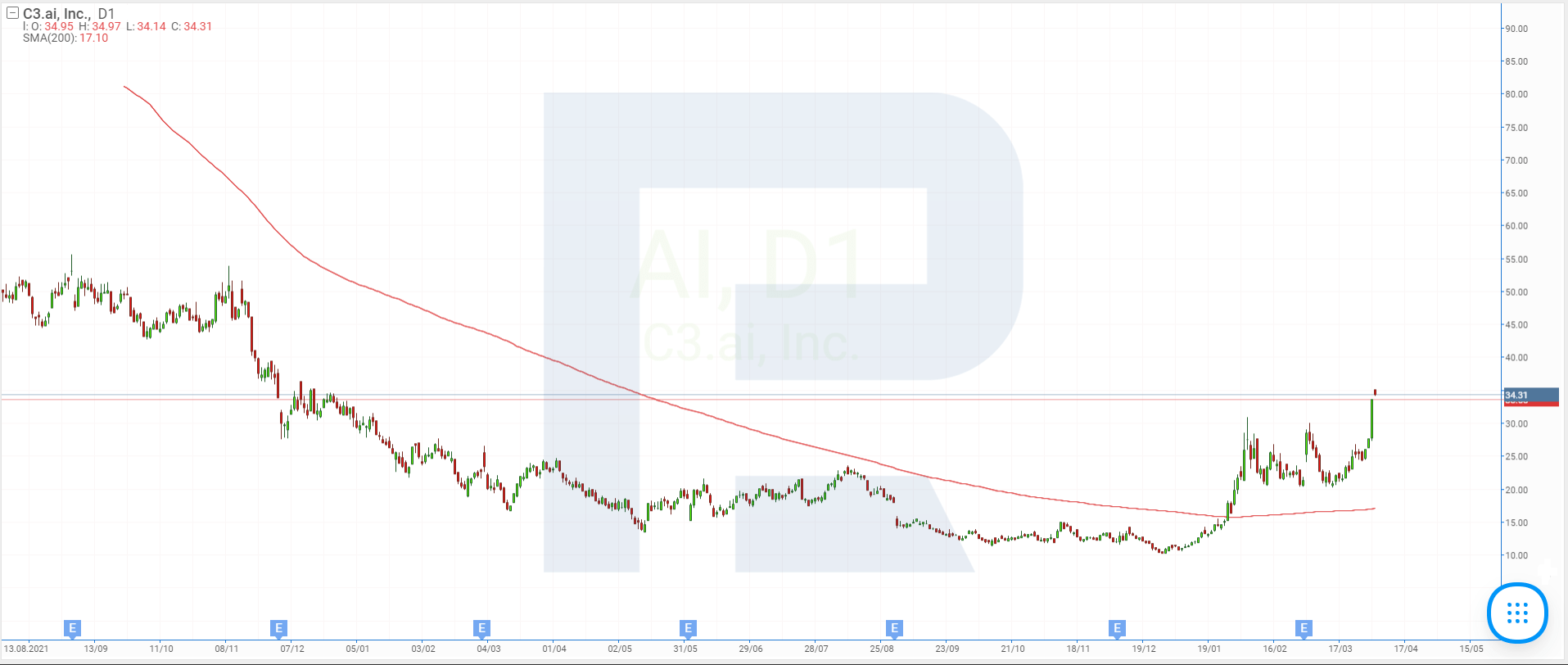

4. C3.ai: +48.67%

Founded in: 2009

Registered in: the US

Head office: Redwood City, California

Sector: technology

Platform: NYSE

Market capitalisation: $3.1 billion

C3.ai Inc. develops software for creating AI-based applications and corporate products. Its clients are from the oil and gas industry, defence forces, car and transport industries, telecommunication sector, finance, healthcare, and more. C3.ai Inc. was on our Top 5 Stocks list in January 2023.

Over March 2023, C3.ai Inc. (NYSE: AI) demonstrated a stock gain of 48.67% from $22.58 to $33.57 per unit. On 2 March, the corporation reported its third-quarter fiscal 2023 results, which exceeded the expectations of Wall Street analysts. In the period from November to January, revenue saw a decline of 4.45% to $66.67 million, net loss increased by 60.12% to $63.16 million, and loss per share rose 50% to $0.57.

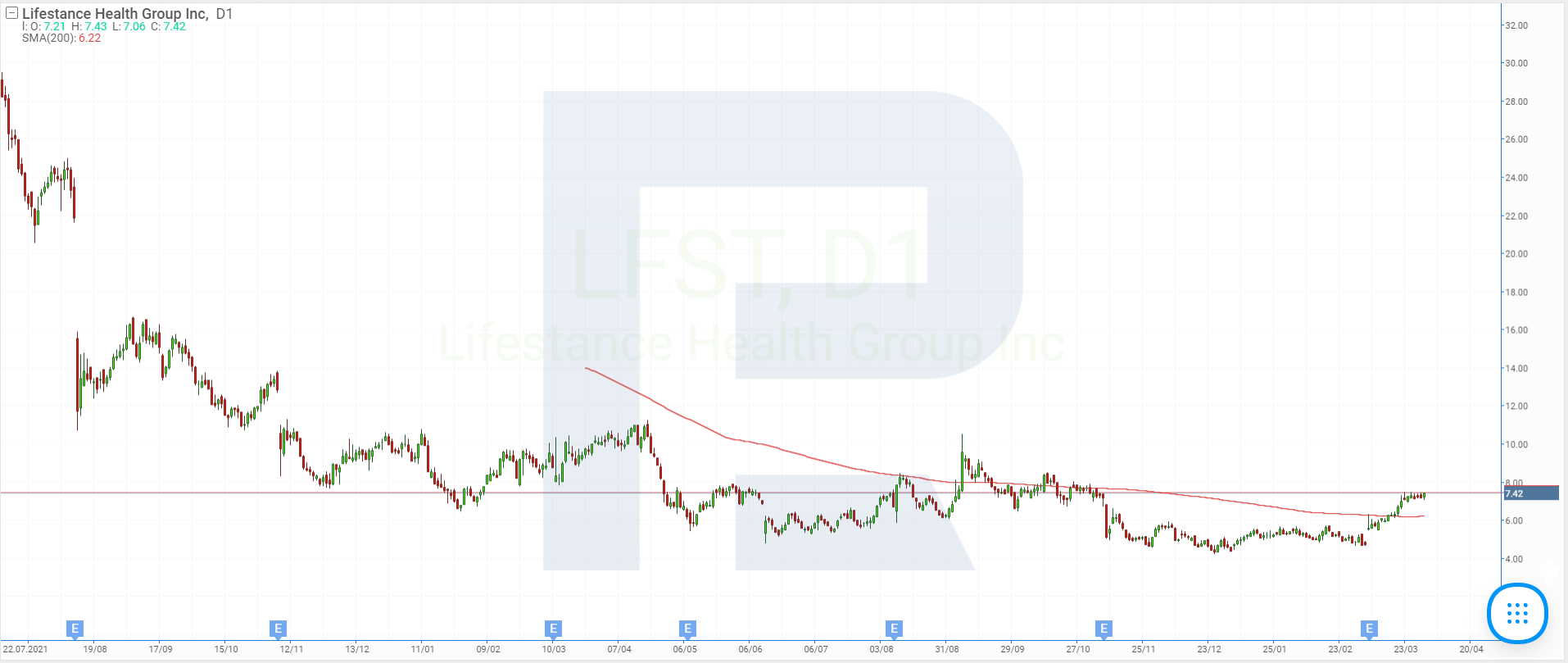

5. LifeStance Health Group: +45.12%

Founded in: 2017

Registered in: the US

Head office: Scottsdale, Arizona

Sector: healthcare

Platform: NASDAQ

Market capitalisation: $2.71 billion

LifeStance Health Group Inc. provides psychiatric and therapy services both online and in-person to children, adolescents, and adults with various mental health conditions.

More than 5,600 company experts practice individual, family, and group therapy. The corporation has over 600 healthcare centres in 34 states.

Over the period in question, LifeStance Health Group Inc. (NASDAQ: LFST) quotes rose by 45.12% from $5.12 to $7.43 per unit. On 8 March, the company shared its fourth-quarter and full 2022 year report. In the period from October to December, revenue increased by 20.67% to $229.4 million, and the net loss dropped by 56.76% to $46.7 million. As for the annual revenue, it increased by 28.76% to $859.5 million, while the net loss saw a decrease of 29.82% to $215.6 million. LifeStance Health Group Inc. management expects revenue in the first quarter of 2023 to reach $242-252 million, and $0.98-1.02 billion over the year.

Stocks with the most prominent declines in March

1. First Republic Bank: -88.63%

Founded in: 1985

Registered in: the US

Head office: San Francisco, California

Sector: finance

Platform: NYSE

Market capitalisation: $2.5 billion

First Republic Bank (NYSE: FRC), a Californian bank specialising in mortgages, in March experienced a stock price crash of 88.63% from $123.01 to $13.99 per unit. The decline was presumably caused by the US banking crisis, the first victims of which were Silicon Valley Bank, Silvergate Capital Corp., and Signature Bank.

During the month, all attempts of the quotes to stop the downward movement and reverse the trend were short-term and unsuccessful. The news that First Republic Bank received $30 billion as deposits from 11 major US banks did not change the situation either.

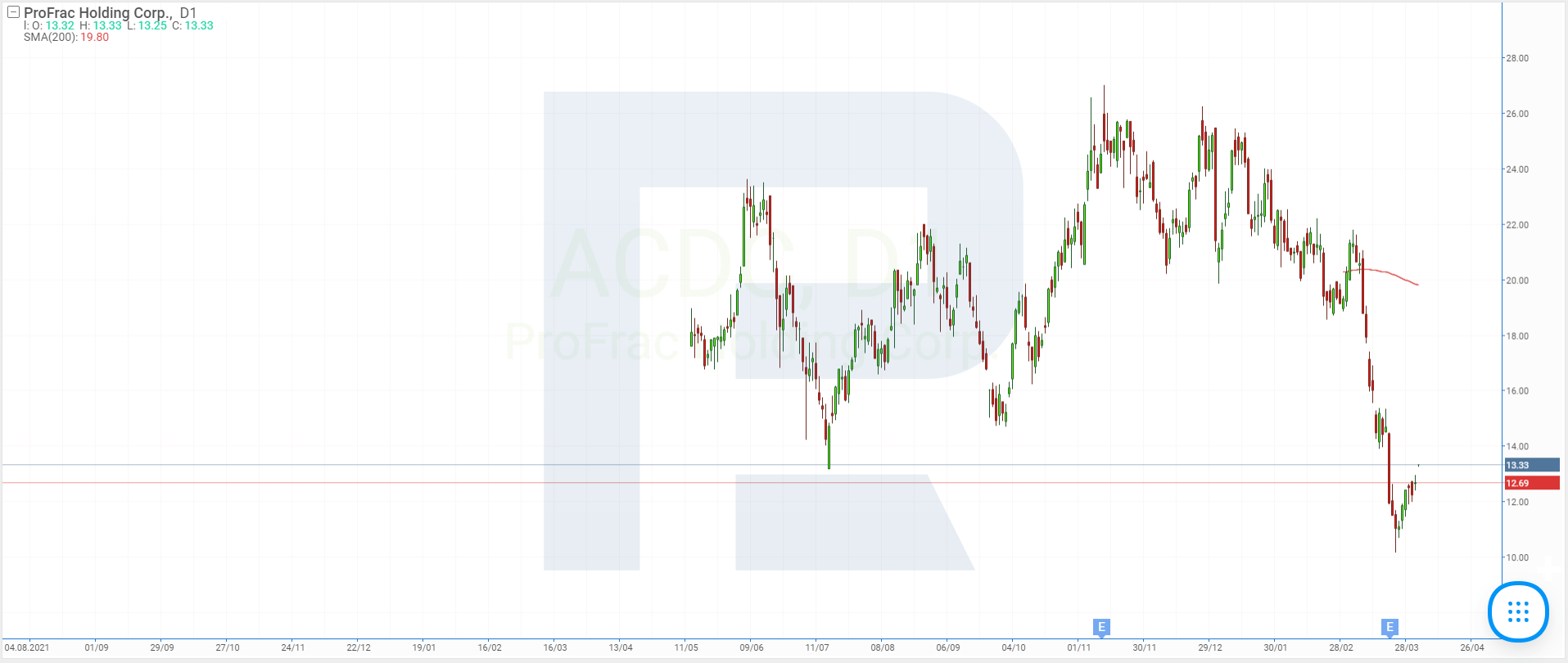

2. ProFrac Holding: -33.77%

Founded in: 2016

Registered in: the US

Head office: Willow Park, Texas

Sector: energy

Platform: NASDAQ

Market capitalisation: $2.01 billion

ProFrac Holding Corp. is a provider of a wide range of technologies, solutions, equipment, and materials for companies specialising in the exploration and mining of oil and natural gas.

ProFrac Holding Corp. (NASDAQ: ACDC) shares in March dropped by 33.77% from $19.13 to $12.67 per unit, with no obvious reason for this decline. The main financial results presented on 21 March in the fourth quarter and full 2022 reports demonstrated solid growth.

3. KeyCorp: -31.55%

Founded in: 1849

Registered in: the US

Head office: Cleveland, Ohio

Sector: finance

Platform: NYSE

Market capitalisation: $11.45 billion

KeyCorp is a financial holding company that owns KeyBank with more than 1,000 offices in 15 states. KeyCorp (NYSE: KEY) quotes last month saw a decline of 31.55% from $18.29 to $12.52 per share. This is likely attributed to the lack of trust in banks, following the crash of Silicon Valley Bank, Silvergate Capital Corp., and Signature Bank.

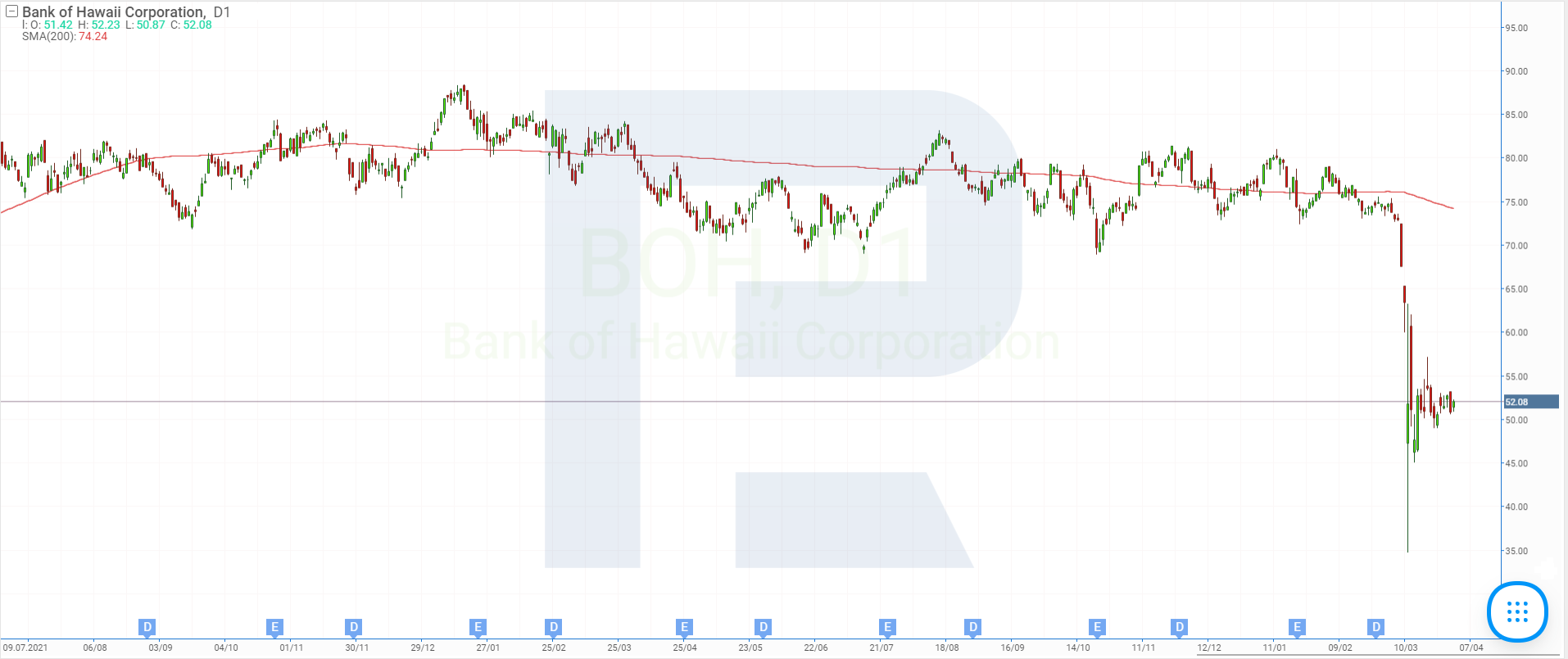

4. Bank of Hawaii: -30.43%

Founded in: 1897

Registered in: the US

Head office: Honolulu, Hawaii

Sector: finance

Platform: NYSE

Market capitalisation: $2.02 billion

Bank of Hawaii Corporation (NYSE: BOH) is a financial holding company that owns Bank of Hawaii, one of the oldest and biggest banks in Hawaii. The stock price decline over the month in question amounted to 30.43%, from $74.87 to $52.08. The corporation experienced the strong negative impact of the challenging situation in the financial sector in March, just like others in the banking sector.

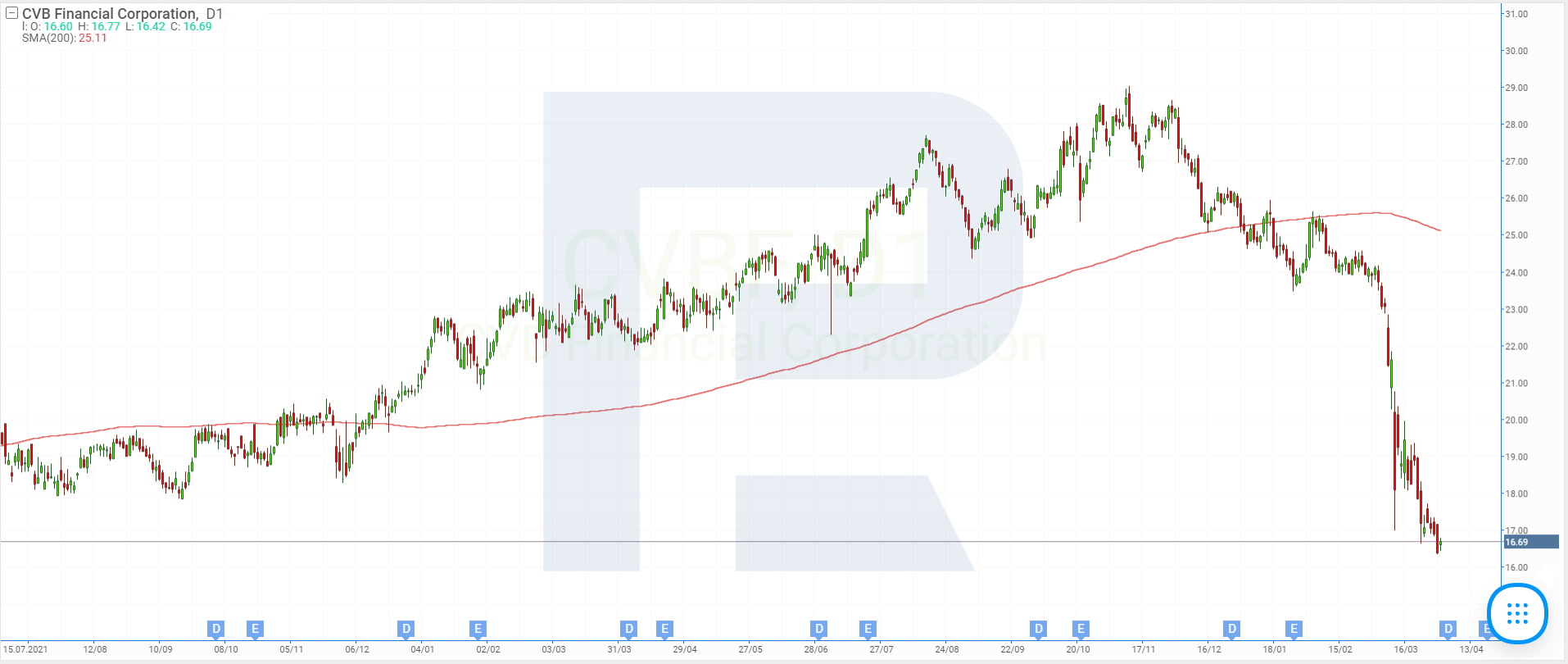

5. CVB Financial: -30.3%

Founded in: 1974

Registered in: the US

Head office: Ontario, California

Sector: finance

Platform: NASDAQ

Market capitalisation: $2.29 billion

This month was not a good one for the financial sector, including CVB Financial Corporation (NASDAQ: CVBF) which manages Citizens Business Bank. Over the last month, the quotes of the company plunged 30.3% from $23.93 to $16.68 per share. The direction and the speed of the stock price movement reflected the general mood in the sector.

Which stocks recorded the most prominent dynamics in March?

The leaders of stock price gains in March were Reata Pharmaceuticals Inc., Enovix Corporation, Duolingo Inc., C3.ai Inc., and LifeStance Health Group Inc. In most cases, the price moves were attributed to strong financial reports. The most noticeable declines, on the other hand, were in the stocks of First Republic Bank, ProFrac Holding Corp., KeyCorp, Bank of Hawaii Corporation, and CVB Financial Corp. The crisis in the banking sector was the main reason for these declines.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high