Top 5 Stocks of January: Leaders of Growth and Decline

8 minutes for reading

The Top 5 list of companies whose stocks demonstrated the most prominent growth in January features Sotera Health Company, Revance Therapeutics Inc., Wayfair Inc., C3.ai Inc., and Rumble Inc. In the same month, the leaders of stock price decline included Calix Inc., Northrop Grumman Corporation, Enphase Energy Inc., Arrowhead Pharmaceuticals Inc., and Pfizer Inc.

Selection criteria

- The stocks are trading on the NYSE or NASDAQ

- The stock price exceeds $2

- The companies are not funds

- Their market capitalisation is above $2 billion

- Their average trading volume of the last 30 days is above 750,000 stocks

Growth and decline were expressed in percent, as the difference between the opening price on 3 January and the closing price on 31 January 2023. The market capitalisation of each company was valid for the moment the article was being prepared.

The stocks with the most prominent growth in January

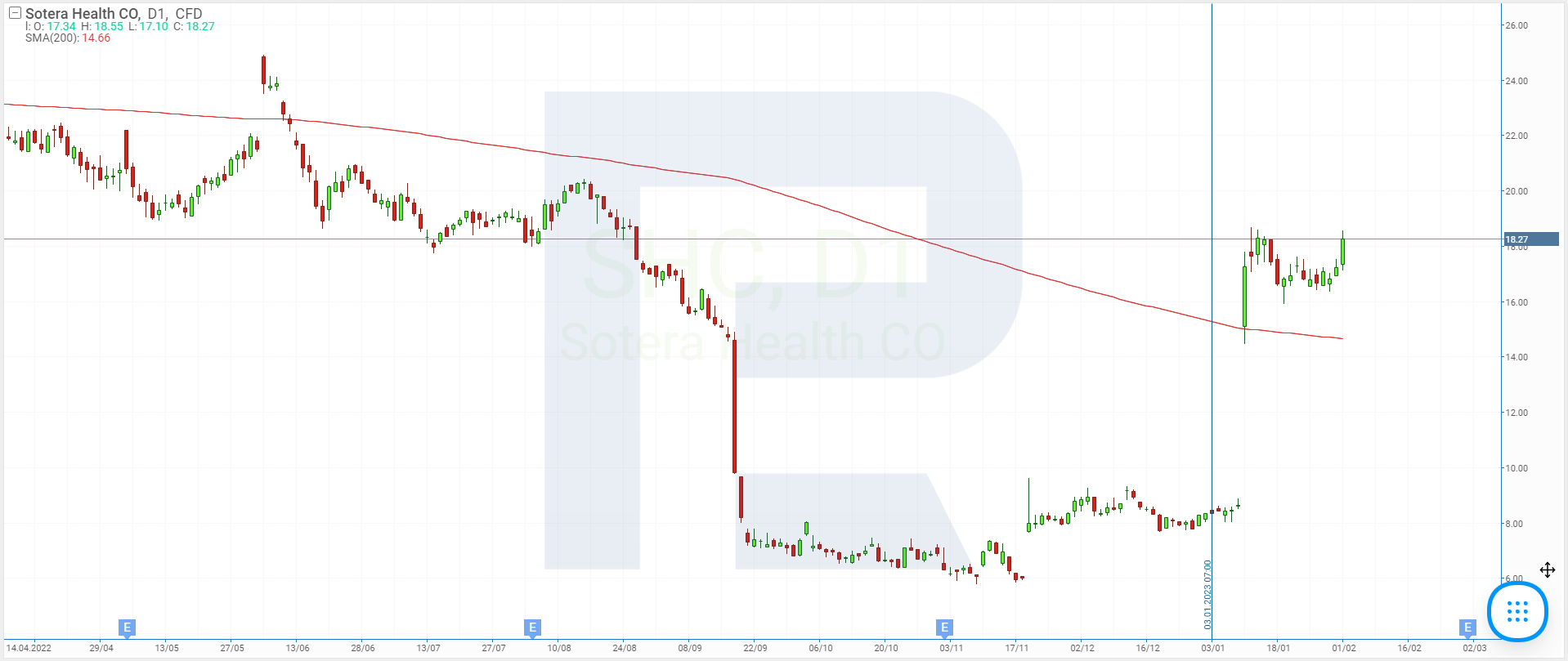

1. Sotera Health: +104.27%

Founded in : 2017

Registered in: the US

Head office: Broadview Heights, Ohio

Sector: healthcare

Platform: NASDAQ

Market capitalisation: $4.75 billion

Sotera Health Company is the world’s leading supplier of critical complex solutions for sterilising medical equipment and facilities. Moreover, the company carries out lab tests and provides consulting services for healthcare entities.

It has around 5,800 clients in more than 50 countries worldwide. The list of clients features 40 out of the 50 leading manufacturers of medical equipment and 8 out of the 10 leading pharma companies.

In January, the stock price of Sotera Health Company (NASDAQ: SHC) recorded a 104.27% growth, from $8.44 to $17.24. On 10 January, the company announced that it had cleared out several lawsuits in the district and federal court of Illinois. The plaintiffs stated that ethylene oxide emissions at a plant of Sotera Health Company were making people from the nearest towns and villages sick.

To resolve the disputes, Sotera Health Company promised to pay the plaintiffs $408 million as compensation. Nonetheless, by this agreement, the company does not admit to the harmful effect of the emissions on people and bears no responsibility for their sickness.

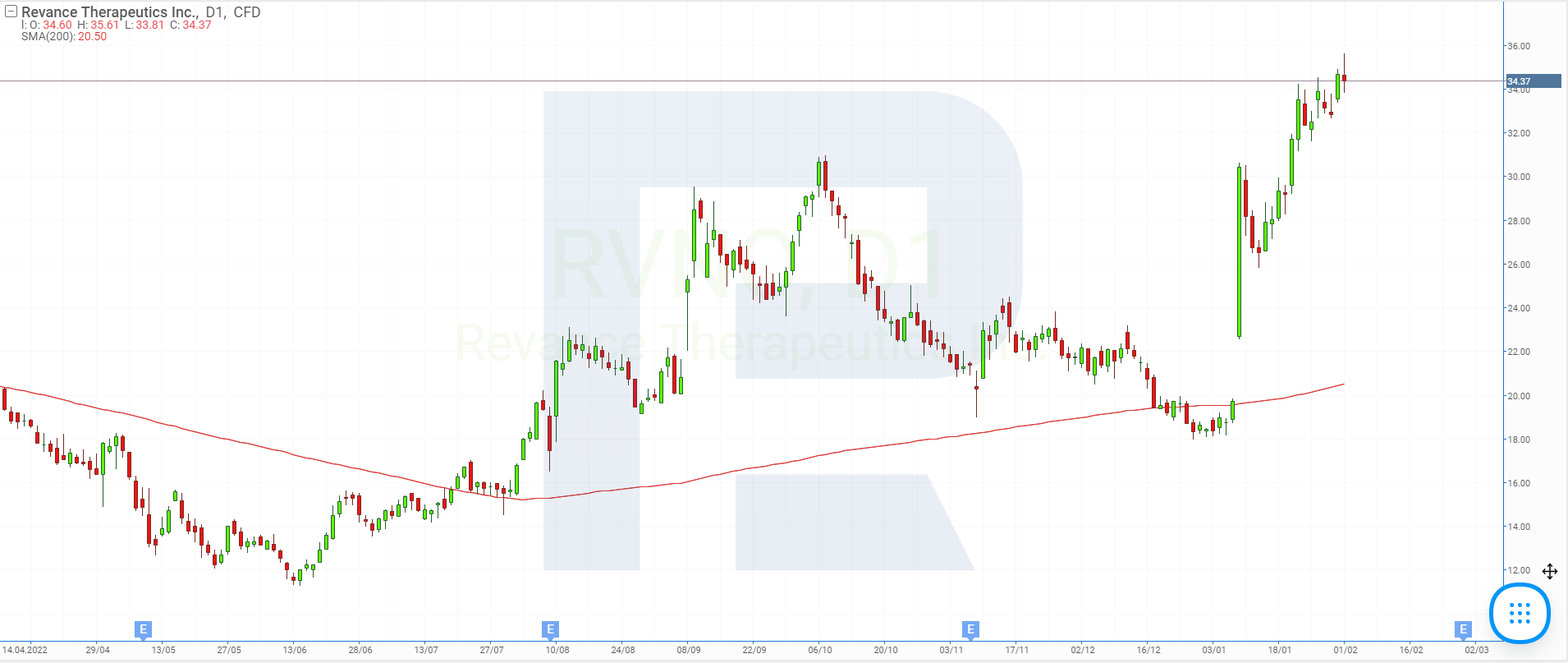

2. Revance Therapeutics: +84.17%

Founded in: 1999

Registered in: the US

Head office: Nashville, Tennessee

Sector: healthcare

Platform: NASDAQ

Market capitalisation: $2.85 billion

Revance Therapeutics Inc. is a biotech company that designs, produces, and commercialises innovative products used in aesthetic medicine and healthcare.

Last month, the stock of Revance Therapeutics Inc. (NASDAQ:RVNC) recorded 84.17% growth, from $18.83 to $34.68. On 9 January, the company shared the preliminary estimation of earnings in Q4, 2022 for the sales of its anti-wrinkle product, Daxxify. The sum is expected to reach $10.5-11.5 million.

Moreover, the US Food and Drug Administration (FDA) accepted an additional application by Revance Therapeutics Inc. for licensing Daxxify as part of the treatment for chronic neurological states of the neck.

3. Wayfair: +78.62%

Founded in: 2002

Registered in: the US

Head office: Boston, Massachusetts

Sector: consumer goods

Platform: NYSE

Market capitalisation: $6.46 billion

Wayfair Inc. is one of the world’s largest online retailers of home appliances. The company offers more than 33 million goods from over 23 thousand suppliers under the brands Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold.

Last month, the quotes of Wayfair Inc. (NYSE:W) recorded 78.62% growth, from $33.87 to $60.5. On 20 January, the company updated its plan for decreasing expenses and announced laying off 10% of its workforce. Analysts from the Bank of America and JPMorgan improved the company’s ratings, changing the rating of its stocks from "Sell" to "Buy".

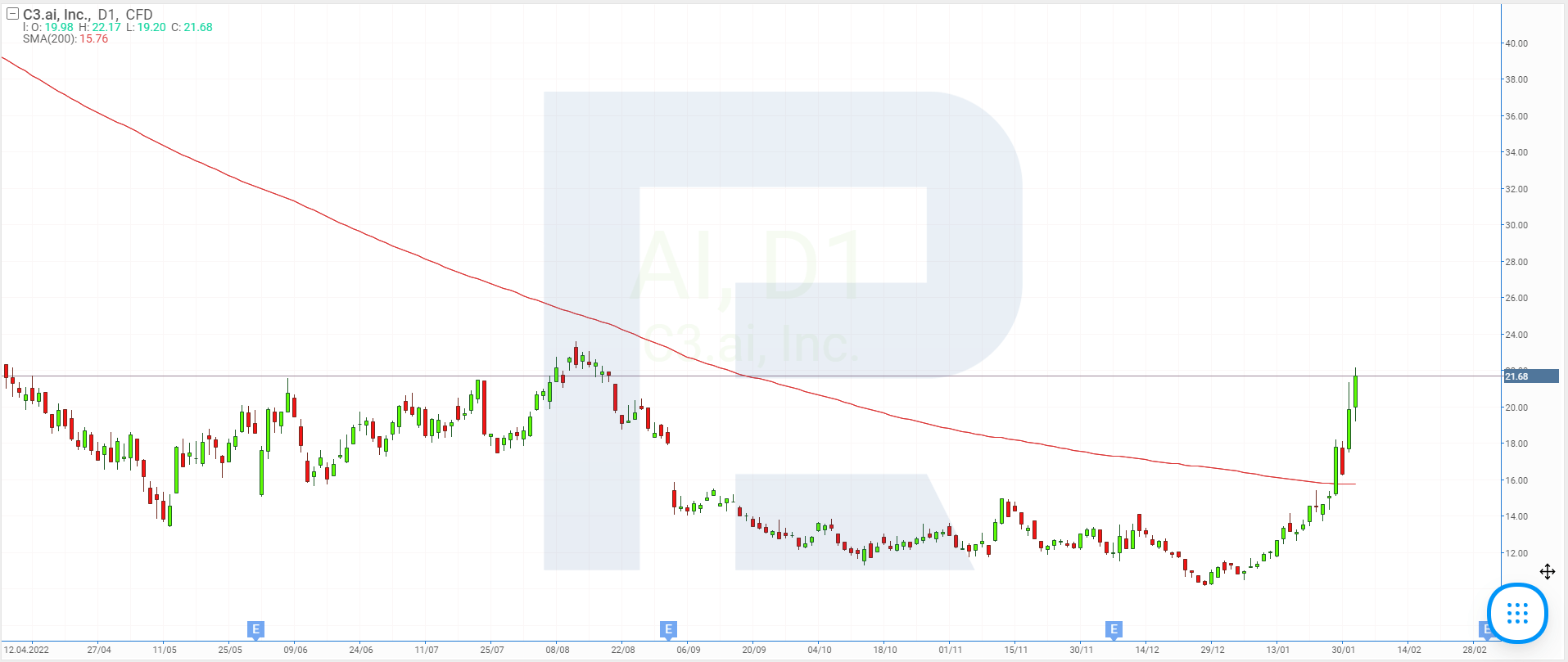

4. C3.ai: +73.67%

Founded in: 2009

Registered in: the US

Head office: Redwood City, California

Sector: technology

Platform: NYSE

Market capitalisation: $2.19 billion

C3.ai Inc. develops software for creating AI-based apps and corporate products. It has clients from the oil & gas, defence, car, and transport industries, as well as the telecom, finance, healthcare industries, and other spheres.

In January, the stocks of C3.ai Inc. (NYSE:AI) recorded a 73.67% growth, from $11.43 to $19.85. On 31 January, the corporation announced the launch of a new pack of products, C3 Generative AI.

One of the innovative AI-based instruments is created for large companies to substantially simplify, speed up and optimise the search of any files and data inside corporate documents.

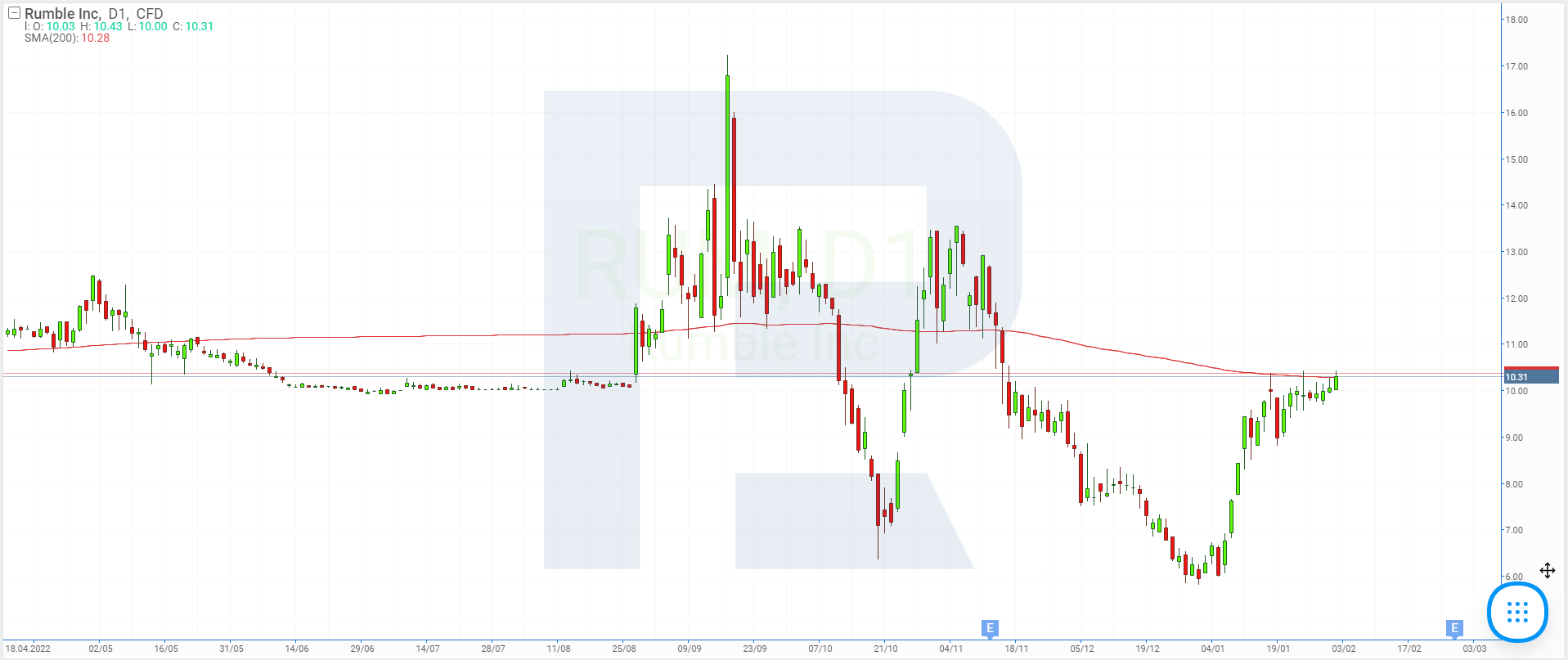

5. Rumble: +65.57%

Founded in: 2013

Registered in: the US

Head office: Longboat Key, Florida

Sector: technology

Platform: NASDAQ

Market capitalisation: $2.51 billion

Rumble Inc. manages platforms for uploading, editing, sharing, viewing, and monetising video content. Moreover, the company provides Cloud services.

Over the first month of 2023, the quotes of Rumble Inc. (NASDAQ:RUM) saw a 65.57% growth, from $6.07 to $10.05. The company announced exclusive partnerships with popular content makers such as Kim Iversen, Donald Trump Jr., Clayton and Natali Morris, Nick Rekieta, and Glenn Greenwald.

The stocks with the most prominent decline in January

1. Calix: -24.24%

Founded in: 1999

Registered in: the US

Head office: San Jose, California

Sector: technology

Platform: NYSE

Market capitalisation: $3.46 billion

Calix Inc. makes Cloud and software platforms, technology, and systems for providers. In January, the stocks of Calix Inc. (NYSE:CALX) declined by 24.24%, from $69.48 to $52.64.

On 25 January, Calix Inc. presented its reports for Q4 and the whole of 2022. Quarterly earnings grew by 38.56% to $244.5 million, while net profit dropped by 39.99% to $11.93 million. Yearly revenue grew by 27.74% to $867.83 million, while net profit dropped by 82.79% to $41.01 million.

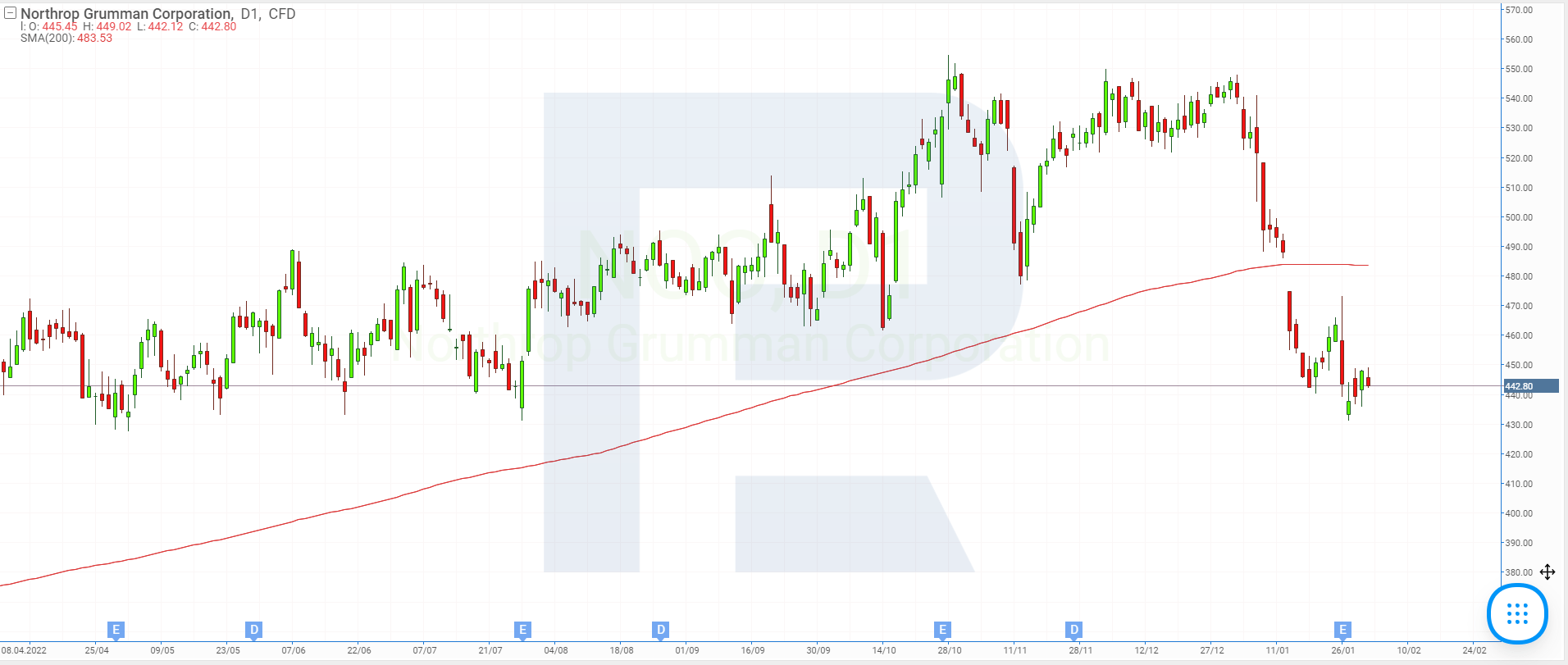

2. Northdrop Grumman: -17.78%

Founded in: 1939

Registered in: the US

Head office: Falls Church, Virginia

Sector: industry

Platform: NYSE

Market capitalisation: $68.86 billion

Northrop Grumman Corporation develops, produces, and sells products for aerospace and defence. Its main clients are the US Ministry of Defense and intelligence structures. The company employs about 95,000 people from 25 countries.

Last month, the quotes of Northrop Grumman Corporation (NYSE:NOC) dropped by 17.78%, from $544.92 to $448.04. On 27 January, the company presented its report for Q4 and the whole of 2022.

Revenue from October - December grew by 16.14% to $10.03 billion; net profit dropped by 23.25% to $2.08 billion, and EPS by 21.47% to $13.46. Yearly revenue grew by 2.62% to $36.6 billion; net profit dropped by 33.11% to $4.89 billion, and EPS by 27.72% to $31.47.

3. Enphase Energy: -17.5%

Founded in: 2006

Registered in: the US

Head office: Fremont, California

Sector: solar energy

Platform: NASDAQ

Market capitalisation: $30.09 billion

Enphase Energy Inc. projects, designs, produces, and sells equipment for generating and storing solar energy, as well as charging stations for cars.

The decline of the stock price of Enphase Energy Inc. (NASDAQ:ENPH) in January amounted to 17.75%, from $269.17 to $221.38. The quotes were declining by a downtrend that started in the stocks of solar companies last month.

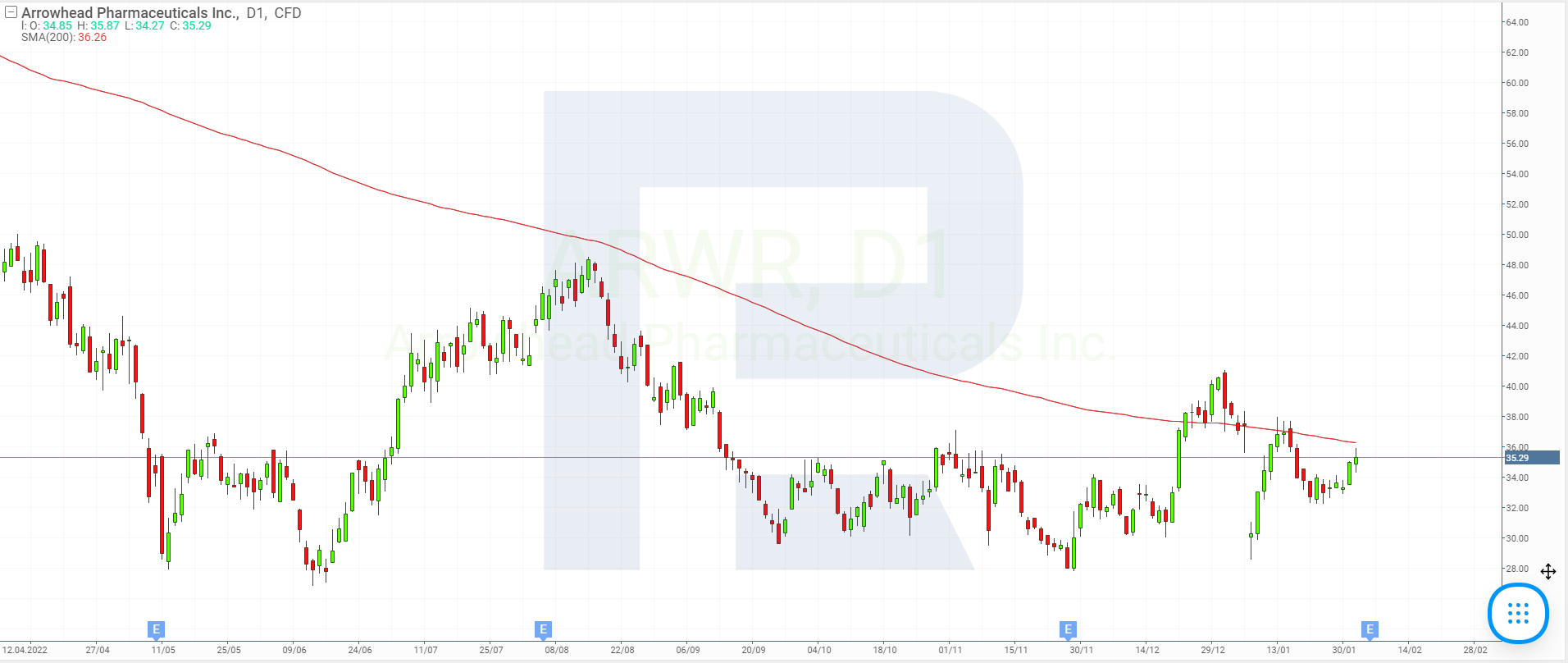

4. Arrowhead Pharmaceuticals: -14.24%

Founded in: 1989

Registered in: the US

Head office: Pasadena, California

Sector: healthcare

Platform: NASDAQ

Market capitalisation: $3.71 billion

Arrowhead Pharmaceuticals Inc. develops innovative drugs for curing intractable diseases. In January, the quotes of Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR) dropped by 14.24%, from $40.8 to $34.99.

On 9 January, the company reported ambiguous results of phase two clinical tests of Fazirsiran, a drug for the liver. On the same day, the quotes of the company dropped by 18.99% to $30.28.

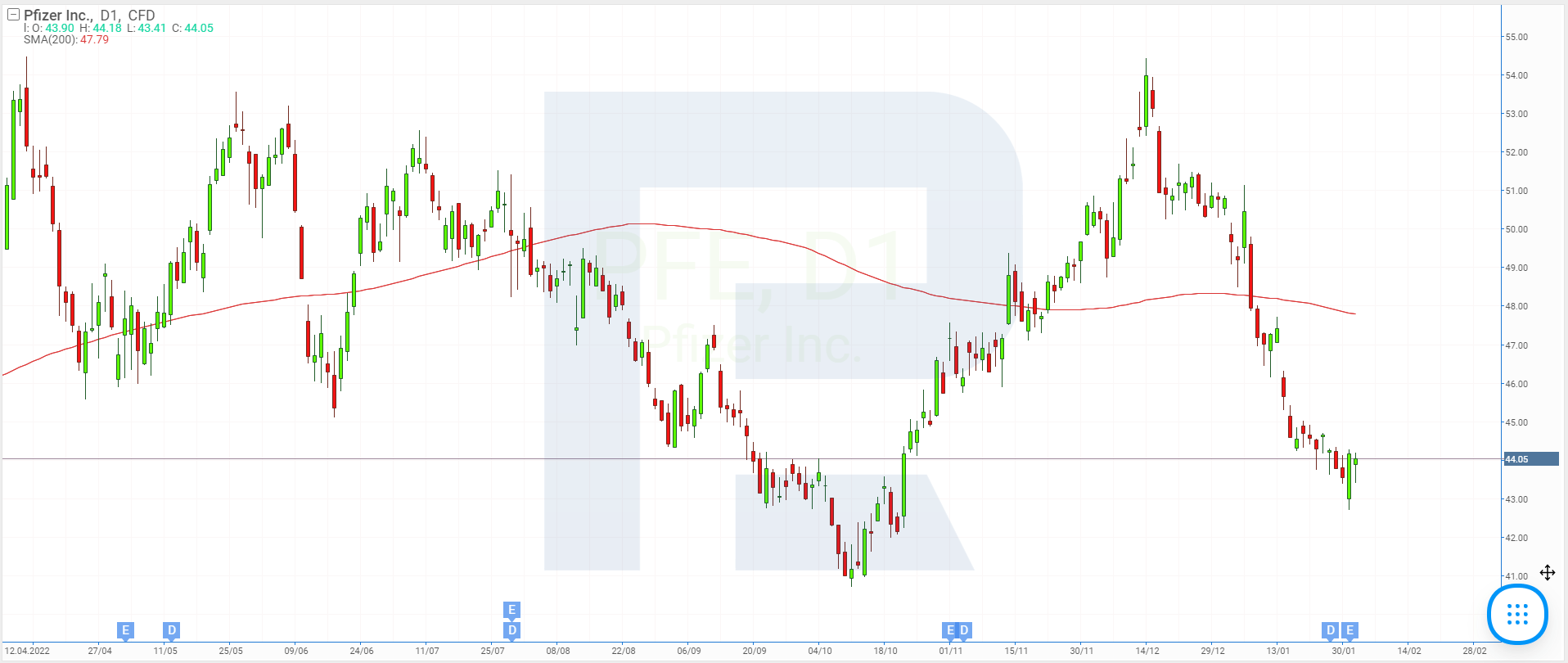

5. Pfizer: -13.43%

Founded in: 1849

Registered in: the US

Head office: New York, New York

Sector: healthcare

Platform: NYSE

Market capitalisation: $248.22 billion

Last month, the quotes of pharma giant Pfizer Inc. (NYSE:PFE) dropped by 13.43%, from $51.01 to $44.16. On 31 January, the company published its report for Q4 and the whole of 2022.

Quarterly revenue grew by 1.89% to $24.29 billion, net profit increased by 47.21% to $4.99 billion, and EPS climbed 47.46% to $0.87. Yearly revenue increased by 23.43% to $100.33 billion, net profit leaped up 42.74% to $31.37 billion, and EPS grew 42.08% to $5.47.

However, Pfizer Inc. forecasts that in 2023, its revenue will decline by about 30%, reaching $67-71 billion. The company expects a significant decrease in the demand for anti-covid drugs, Comirnaty and Paxlovid.

Which stocks demonstrated the most prominent dynamics in January?

The leaders of stock price growth in January are Sotera Health Company, Revance Therapeutics Inc., Wayfair Inc., C3.ai Inc. and Rumble Inc. Each company had its own reason for the growth.

The most prominent decline of the stock price was demonstrated by such companies as Calix Inc., Northrop Grumman Corporation, Enphase Energy Inc., Arrowhead Pharmaceuticals Inc., and Pfizer Inc. In most of the cases, the decline was attributed to the poor quarterly and yearly reports.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high