Top 5 Stocks With the Most Prominent Growth in November

5 minutes for reading

The Top 5 list of companies whose stocks demonstrated the most noticeable growth this November features MINISO Group Holding Limited, Tencent Music Entertainment Group, Bilibili Inc., Futu Holdings Limited, and Full Truck Alliance Co. Ltd.

Selection criteria

- The stocks are traded on the NYSE and NASDAQ

- The stock price is more than $2

- The companies are not funds

- Their capitalisation is more than $2 billion

- Average trading volume of the last 30 days exceeds 750,000 stocks

Growth was expressed in percent as the difference between the opening price on 1 November and the closing price on 30 November 2022. The market capitalisation of each company was valid for the time the article was being prepared.

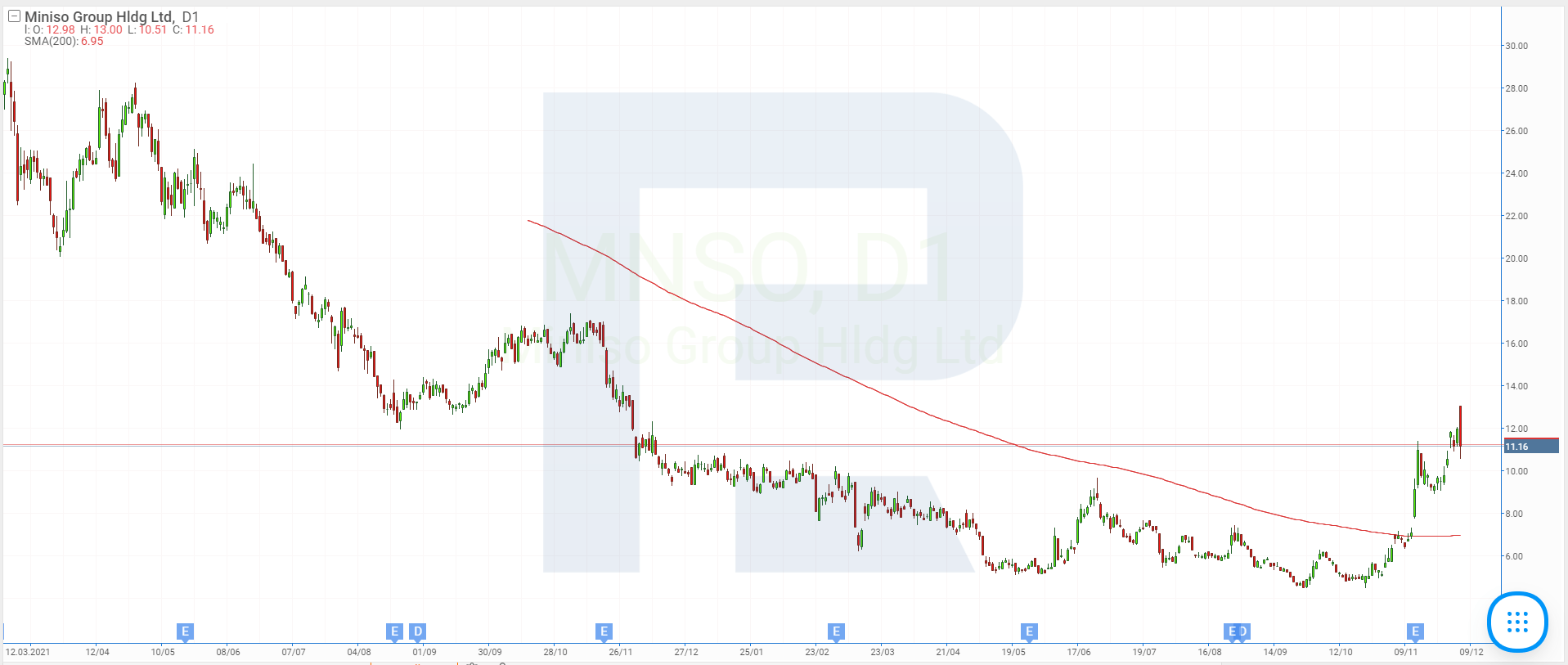

1. MINISO Group Holding – 117.1%

Founded in: 2013

Registered in: China

Head office: Guangzhou, China

Sector: consumer goods

Platform: NYSE

Market capitalisation: $3.9 billion

MINISO Group Holding Limited produces and sells (retail and wholesale) high-quality home appliances, makeup products, foods, and toys. On 30 September 2022, the international chain of the company included 5,296 companies worldwide.

In November, the share price of MINISO Group Holding Limited (NYSE:MNSO) soared by 117.1% from $5.44 to $11.81. On 14 November, the company published its financial report for Q1, financial 2023.

The earnings of MINISO Group Holding Limited in July-September this year (compared to the statistics of the same period of 2021) recorded a 4.5% growth to $389.7 million, net profit skyrocketed by 490.2% to $3.5 million, and EPS by 164% to $0.19.

2. Tencent Music Entertainment – 82.1%

Founded in: 2016

Registered in: China

Head office: Shenzhen, China

Sector: communication services

Platform: NYSE

Market capitalisation: $11.8 billion

Tencent Music Entertainment Group develops entertainment services for music broadcasting in the Chinese market. The company owns such products as QQ Music, Kugou Music, Kuwo Music, and WeSing. The number of users of these services is over 800 million people.

Last month, the quotes of Tencent Music Entertainment Group (NYSE:TME) skyrocketed 82.1% from $3.85 to $7.01. On 15 November, the company presented its Q3 report.

The earnings of Tencent Music Entertainment Group in July-September dropped by 5.6% to $1.04 billion, while the net profit grew by 38.7% to $154 million, and EPS increased by 48.9% to $0.09. Moreover, the number of paid subscriptions to the company’s services increased by 19.8% to 85.3 million people.

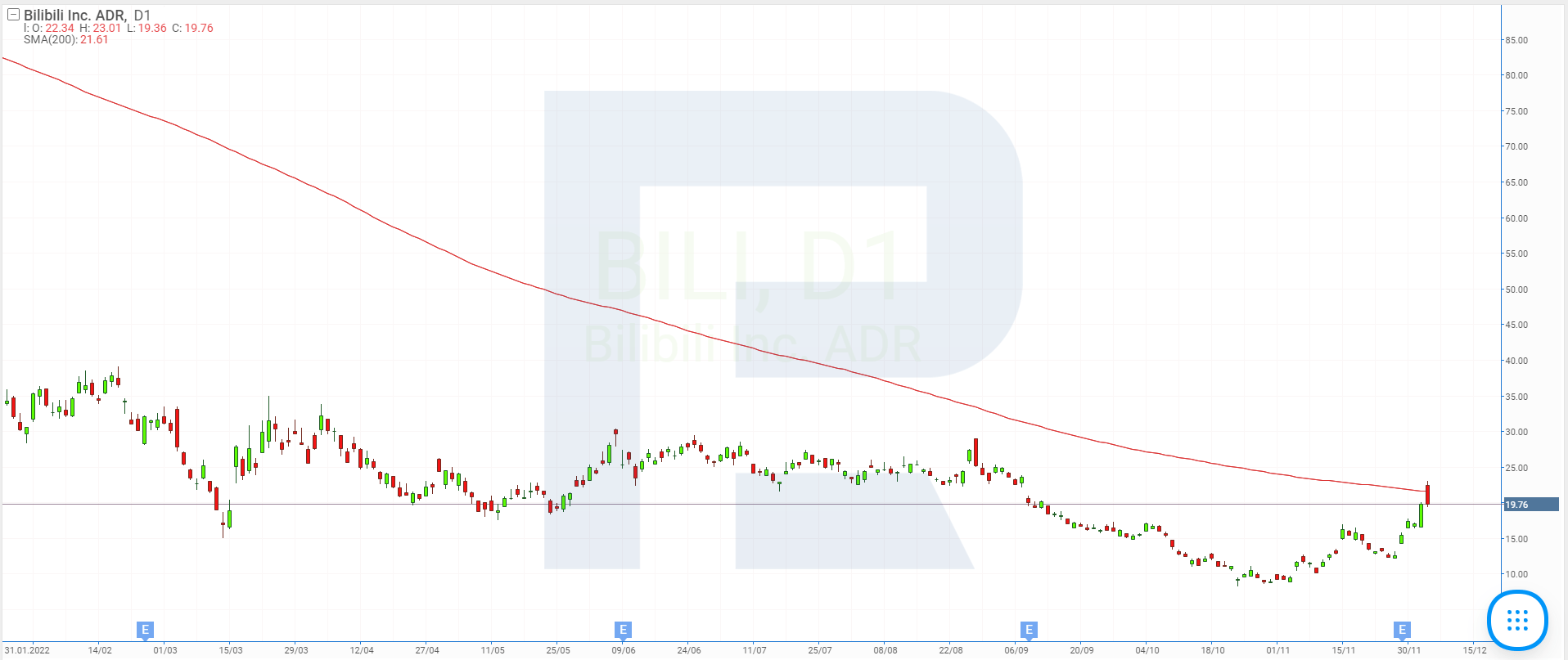

3. Bilibili – 77.7%

Founded in: 2009

Registered in: China

Head office: Shanghai, China

Sector: online entertainment and games

Platform: NASDAQ

Market capitalisation: $6.8 billion

Bilibili Inc. specialises in online entertainment for youngsters. The Chinese corporation develops online games, issues comics, and owns audio services and platforms for creating and sharing video content.

The stock of Bilibili Inc. (NASDAQ:BILI) soared 77.7% last month, from $9.77 to $17.36. On 29 November, the company reported its performance in Q3, 2022, demonstrating an 11% growth in earnings to $814.5 million and a decrease in the net loss by 36% to $241.2 million.

The number of Day Average Users (DAU) and Month Average Users (MAU) over July-September recorded a 25% increase to 90.3 million and 332.6 million people, respectively. The average number of Month Paid Users (MPU) increased by 19% to 28.5 million.

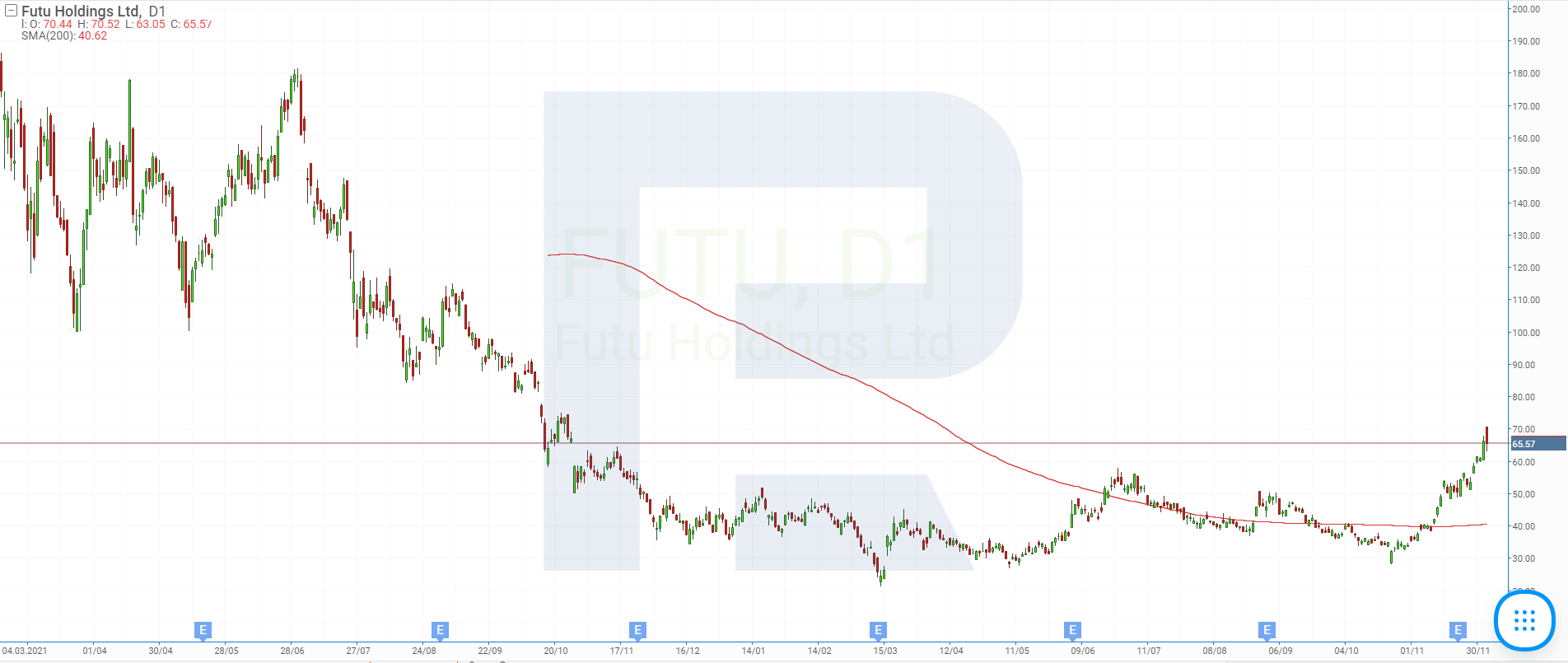

4. Futu Holdings – 68.5%

Founded in: 2007

Registered in: China

Head office: Hong Kong, China

Sector: financial services

Platform: NASDAQ

Market capitalisation: $9.2 billion

Futu Holdings Limited is a fintech company that owns digital platforms for broker services and asset management. The company provides a wide range of investment services via the Futubull and moomoo services.

In November, the shares of Futu Holdings Limited (NASDAQ:FUTU) recorded a 68.5% growth from $36.5 to $61.49. On 21 November, the holding presented its quarterly statistics.

Futu Holdings Limited's Q3 earnings increased by 12.4% to $247.9 million, net profit recorded a 22.7% growth to $96.1 million, and EPS grew 34% to $0.09. The overall number of users over July-September increased by 15% to 19.2 million, and the number of registered clients grew by 21.4% to 3.1 million people.

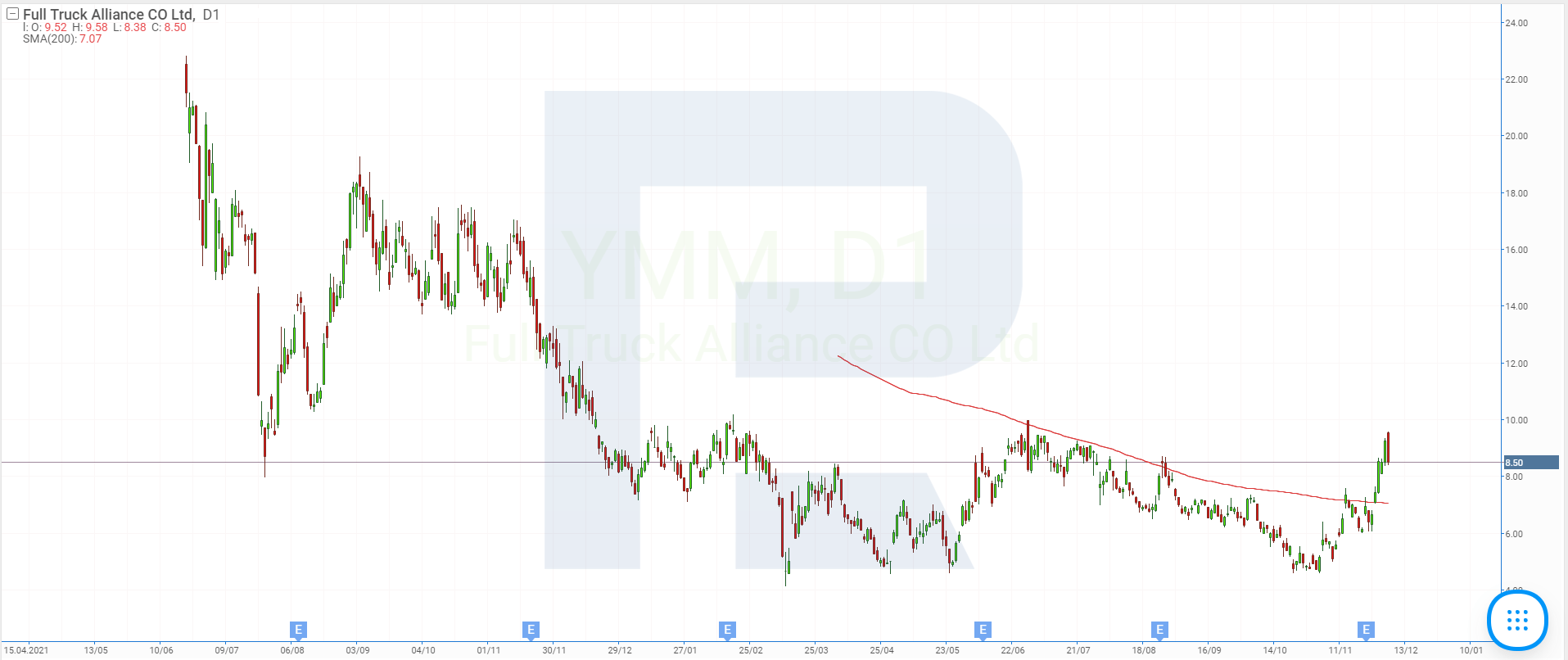

5. Full Truck Alliance – 64.8%

Founded in: 2011

Registered in: China

Head office: Guiyang, China

Sector: tech services

Platform: NYSE

Market capitalisation: $9.4 billion

Full Truck Alliance Co. Ltd. manages a digital service for ordering and paying for car cargo transportation. Thanks to this product, shippers are able to find carriers online. 128.3 million orders were made on the platform in 2021 alone.

In November, the share price of Full Truck Alliance Co. Ltd. (NYSE:YMM) soared 64.8% from $5.17 to $8.52. On 23 November, the company presented its results for Q3, 2022.

The earnings of Full Truck Alliance Co. Ltd. in the period from July-September increased by 45.7% to $254.3 million, net profit skyrocketed by a whopping 321.8% to $55.6 million, and EPS by 317.7% to $0.05. In Q3, the MAU increased by 15.2% to 1.85 million people.

What influenced the growth of stocks in November?

The leaders of stock price growth in November were MINISO Group Holding Limited, Tencent Music Entertainment Group, Bilibili Inc., Futu Holdings Limited, and Full Truck Alliance Co. Ltd. All these companies are registered in China.

The skyrocketing of their stock prices is attributed to the strong quarterly statistics and the alleviation of quarantine measures that had been previously introduced in China due to the new increase in COVID-19 cases.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high