Top Gaining Stocks of October 2023

6 minutes for reading

ImmunityBio Inc., Spirit Aerosystems Holdings Inc., AMC Entertainment Holdings Inc., Textainer Group Holdings Limited, and Apellis Pharmaceuticals Inc. were among the top five growth stocks in October 2023. Let us find out what has affected these companies’ stock values.

Selection criteria for companies:

- The stock is traded on the NYSE and NASDAQ

- The share price exceeds 2 USD

- The companies are not classified as funds

- Their market capitalisation is over 2 billion USD

- The average trading volume for the last 30 days is more than 750,000 shares

Growth values were determined as the percentage difference between the opening prices on 2 October and the closing prices on 31 October 2023. The market capitalisation of the companies was valid as of the time of writing on 1 November 2023.

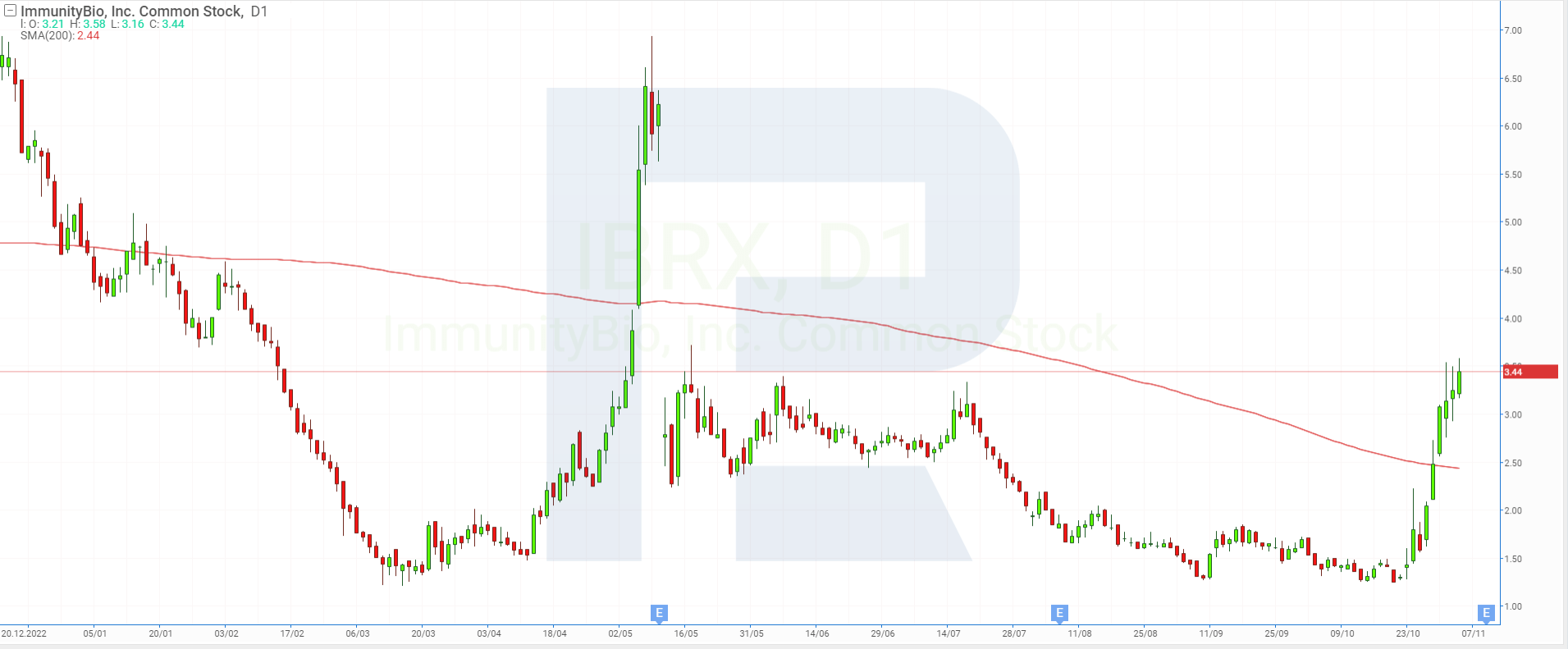

1. ImmunityBio: +84.71%

Founded in: 2014

Registered in: the US

Headquarters: San Diego, California

Sector: healthcare

Platform: NASDAQ

Market capitalisation: 2.10 billion USD

ImmunityBio Inc. is a clinical-stage biotechnology company developing next-generation therapies and vaccines that bolster the natural immune system to combat cancers and infectious diseases. The company’s primary markets are the US and European countries.

ImmunityBio Inc. (NASDAQ: IBRX) stock surged 84.71% in October 2023, rising from 1.7 USD to 3.14 USD per unit. On 23 October, the company announced the resubmission of a biological licence application (BLA) to the US Food and Drug Administration (FDA) for N-803 (Anktiva®), developed for the treatment of bladder cancer.

On 26 October, it was announced that the FDA had accepted the resubmission of ImmunityBio Inc.’s BLA as complete and set a user fee goal date (PDUFA date) of 23 April 2024. It is worth noting that in May 2023, the US regulator rejected the first application of ImmunityBio Inc. due to an insufficient volume of data provided.

2. Spirit Aerosystems Holdings: +40.63%

Founded in: 2005

Registered in: the US

Headquarters: Wichita, Kansas

Sector: industrial

Platform: NYSE

Market capitalisation: 2.38 billion USD

Spirit AeroSystems Holdings Inc. designs, manufactures, and markets commercial aerostructures. A key client of the firm is The Boeing Company. The corporation operates in commercial, defense, and space segments and also provides aftermarket maintenance services.

Spirit AeroSystems Holdings Inc. (NYSE: SPR) shares gained 40.63% over the past month, rising from 16.07 USD to 22.6 USD per unit. On 18 October 2023, Spirit AeroSystems Holdings Inc. published a press release to inform that it had entered into a Memorandum of Agreement (MoA) with The Boeing Company.

The parties are seeking closer collaboration to increase the output rate, enhance product quality, and achieve higher deliveries in the future.

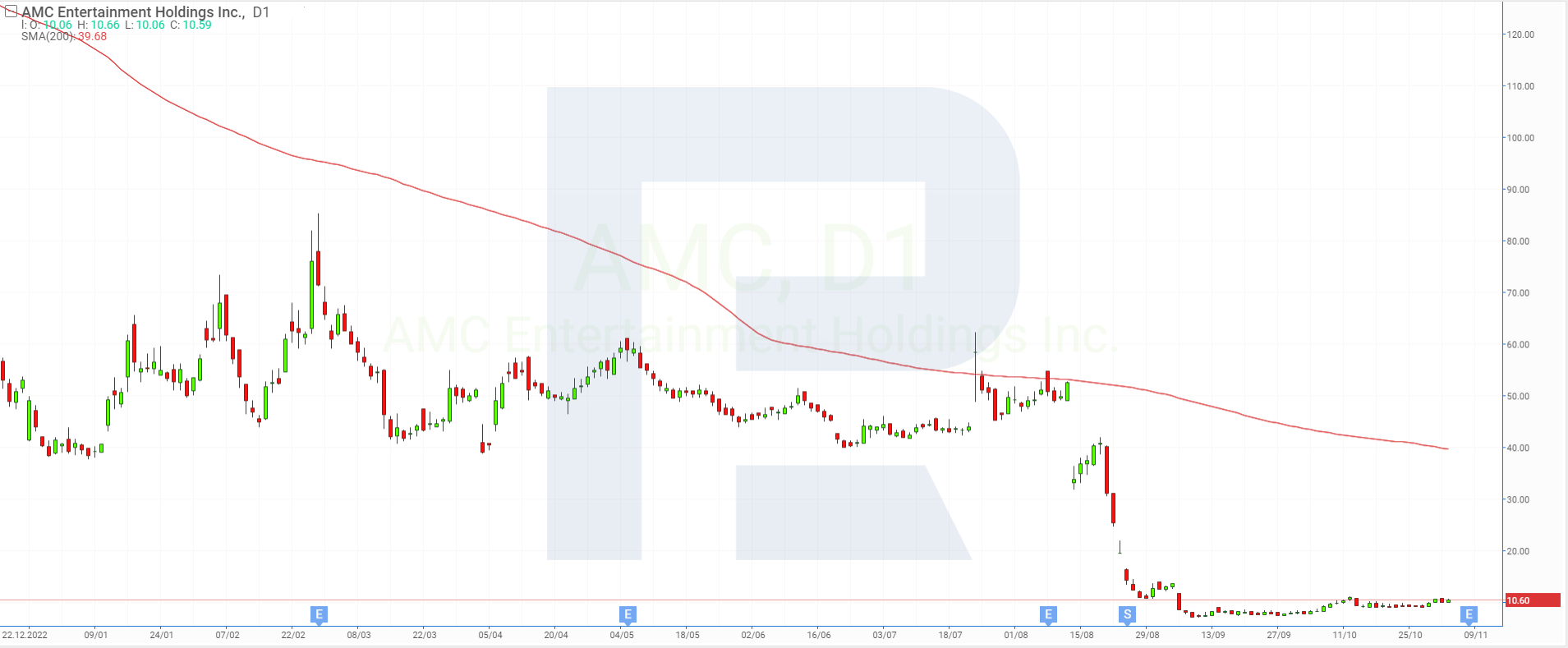

3. AMC Entertainment Holdings: +32.75%

Founded in: 1920

Registered in: the US

Headquarters: Leawood, Kansas

Sector: communication services

Platform: NYSE

Market capitalisation: 2.12 billion USD

The stock of AMC Entertainment Holdings Inc. (NYSE: AMC), which owns one of the world’s most prominent cinema chains, climbed 32.75% for the period in question, rising from 8.06 USD to 10.7 USD.

On 5 October 2023, AMC Entertainment Holdings Inc. announced that the concert film TAYLOR SWIFT | THE ERAS TOUR had surpassed 100 million USD in advance ticket sales revenue more than a week before the cinema debut.

The press release further mentions that the film will be screened in over 8,500 cinemas across 100 countries around the world starting from 13 October. It also informs that it set a new AMC record by achieving the highest single-day ticket sales revenue in less than 24 hours.

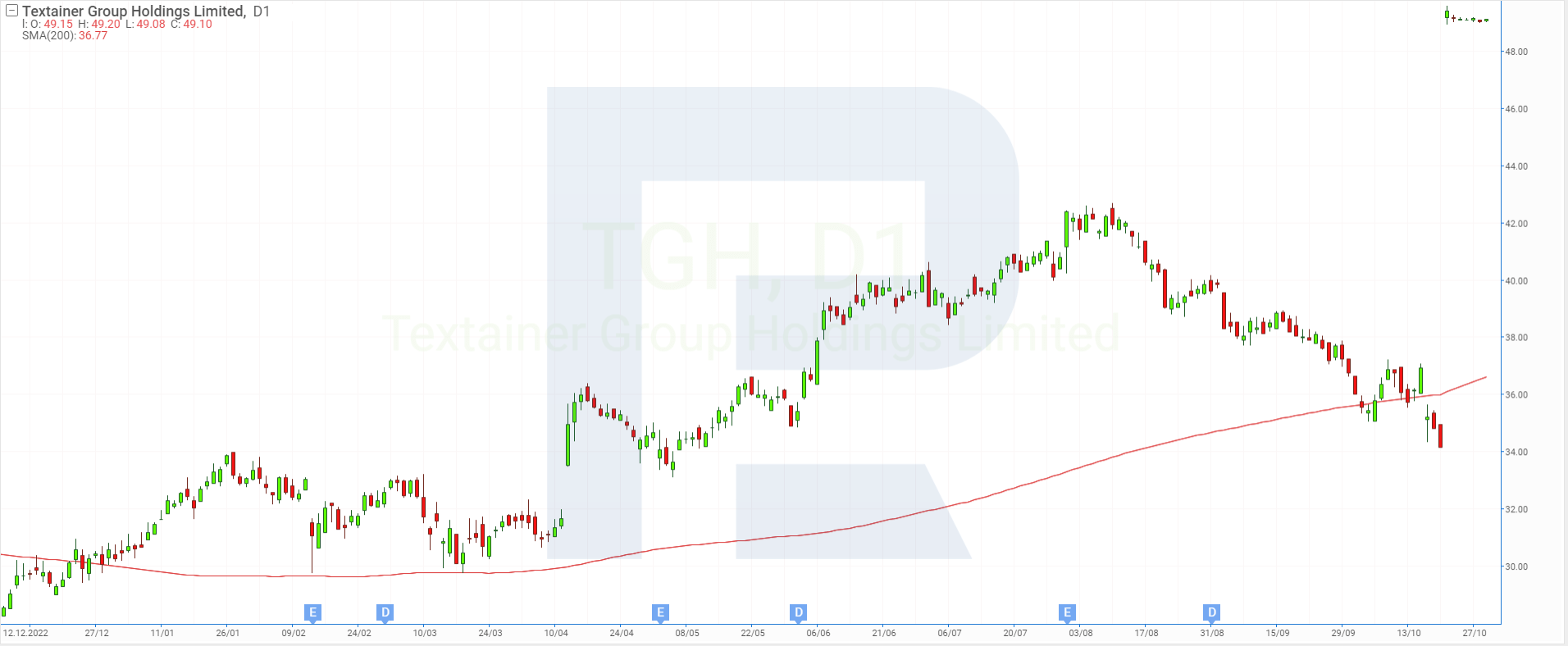

4. Textainer Group Holdings: +31.94%

Founded in: 1979

Registered in: Bermuda

Headquarters: Hamilton, Bermuda

Sector: industrial

Platform: NYSE

Market capitalisation: 2.01 billion USD

Textainer Group Holdings Limited specialises in owning, purchasing, selling, and leasing intermodal containers. The company is one of the world’s largest intermodal container lessors, with over 4 million TEU in its owned and managed fleet. The Textainer team operates through a network of 14 offices and 400 depots covering all time zones.

In October, Textainer Group Holdings Limited (NYSE: TGH) shares increased by 31.94%, climbing from 37.23 USD to 49.12 USD. On 22 October 2023, it was announced that Textainer Group Holdings Limited would be sold to US investment company Stonepeak Partners LP for 7.4 billion USD.

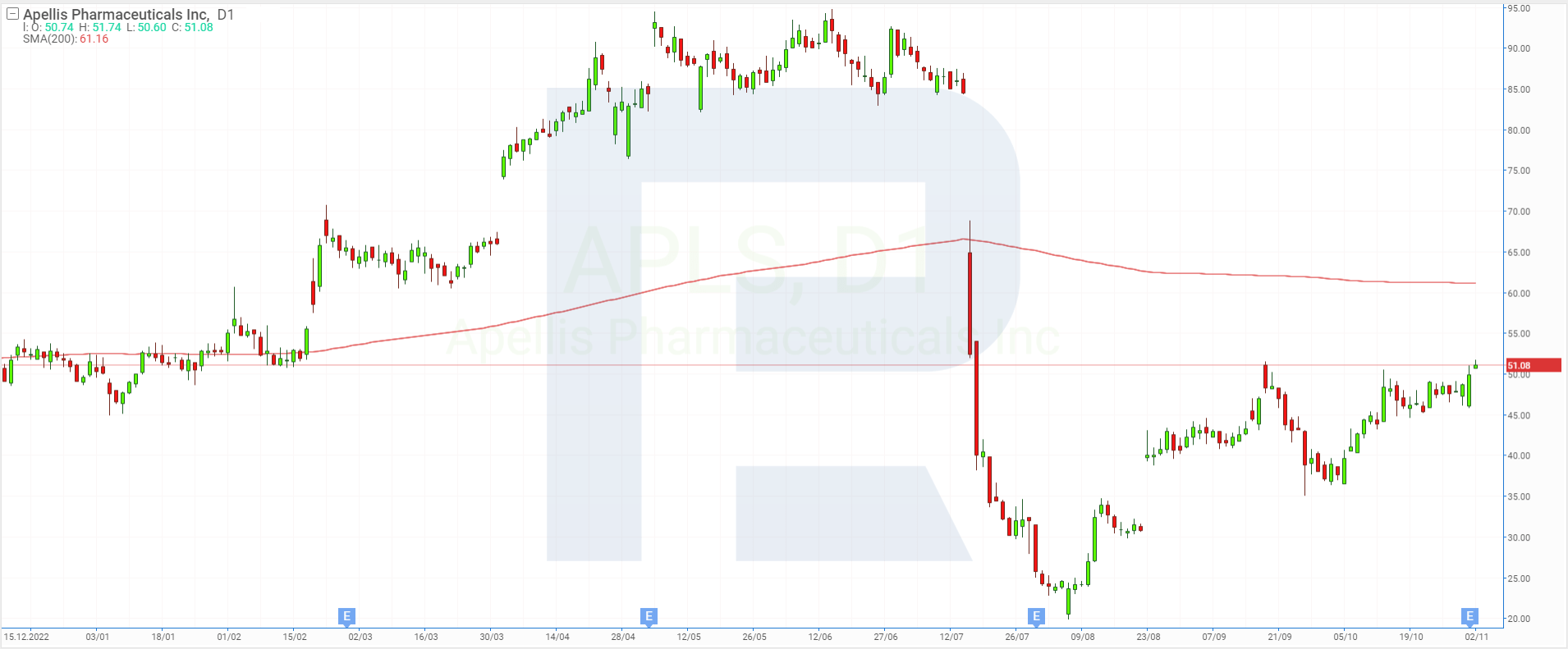

5. Apellis Pharmaceuticals: +27.57%

Founded in: 2009

Registered in: the US

Headquarters: Waltham, Massachusetts

Sector: healthcare

Platform: NASDAQ

Market capitalisation: 5.73 billion USD

Apellis Pharmaceuticals Inc. (NASDAQ: APLS), which develops medicines for treating autoimmune and inflammatory diseases, added 27.57% over the past month, rising from 38.75 USD to 48.66 USD per unit.

On 2 October 2023, Apellis Pharmaceuticals Inc. announced FDA approval of the EMPAVELI® Injector. This is a compact, single-use, on-body device designed to enhance self-administration of EMPAVELI®, which is approved for adults with paroxysmal nocturnal hemoglobinuria (PNH).

On 5 October, Apellis Pharmaceuticals Inc. reported preliminary US revenue from sales of SYFOVRE® (pegcetacoplan injection) in Q3 2023. The figure is expected to reach 74 million USD, and the preliminary total US revenue from SYFOVRE since its launch in March 2023 through 30 September 2023 is projected to be approximately 160 million USD.

Apellis Pharmaceuticals Inc. published a press release on 17 October 2023 to present positive results from the Phase 2 study investigating pegcetacoplan for the treatment of post-transplant recurrence. It was announced that patients treated with the medicine showed improvements across key clinical measures.

Top stocks with prominent dynamics in October 2023

The leaders of stock price gains in October 2023 were ImmunityBio Inc., Spirit Aerosystems Holdings Inc., AMC Entertainment Holdings Inc., Textainer Group Holdings Limited, and Apellis Pharmaceuticals Inc. Possible factors contributing to the rise in these companies’ stock prices were the deals with other companies and positive decisions of the regulator – FDA. It is worth noting that the top list features two representatives from the healthcare sector and two from the industry sector, while one other company operates in the communication services sector.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high