Xpeng Stock Price is Forming an Uptrend; Should Further Growth Be Expected?

7 minutes for reading

The stock of Chinese electric vehicle manufacturer Xpeng Inc. (NYSE: XPEV) has skyrocketed more than 135% since June 2023. The stock price chart demonstrated remarkable fluctuations during this period, with the downtrend coming to an end and the first signs of an uptrend emerging. What has driven the surge in quotes, and should this upward movement be expected to continue? We aim to answer these and other important questions in today’s article.

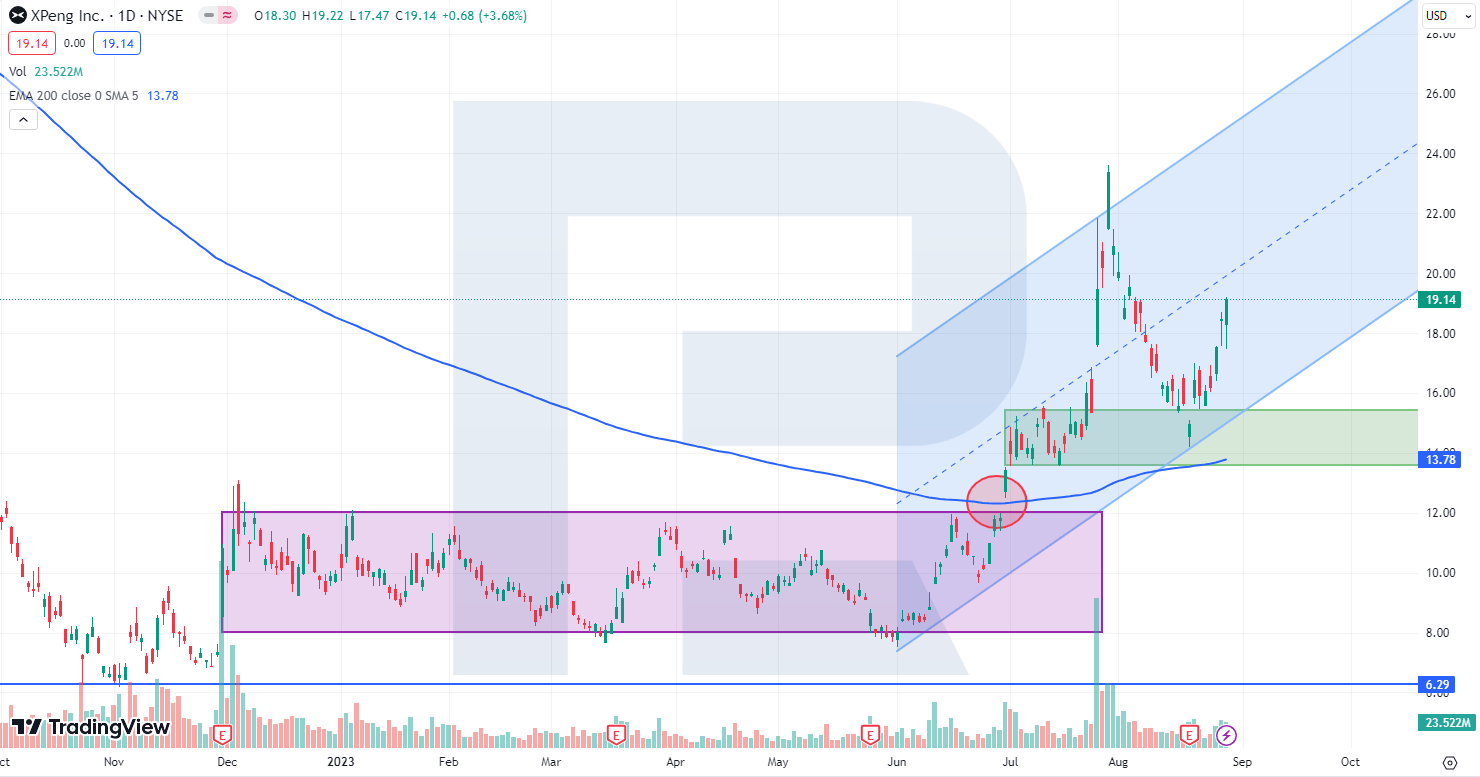

Technical analysis of Xpeng stock

Xpeng Inc. stock reached a high of 72.17 USD in November 2020, followed by a decline that lasted until November 2022. Over this period, the shares of the EV maker plummeted more than 90%, down to 6.18 USD.

The rapid downward movement of the price came to a halt after November 2022, when the shares traded between 8 to 12 USD until June 2023. On 30 June, the quotes surpassed the upper boundary of the range and broke the 200-day Moving Average. This could indicate the end of the downtrend and the potential beginning of an uptrend.

After breaking through the resistance level at 12 USD, the quotes hit a high of 23.62 USD. This was followed by a corrective movement to the Moving Average, which stopped at the level of 14.21 USD. As a result, this formed two lows, allowing the formation of an ascending trendline. The first one is located at 7.51 USD, while the second one stands at 14.21 USD. This is another signal pointing towards a potential uptrend.

Technical analysis shows that Xpeng Inc.’s stock price chart presents conditions for further price growth. However, the high volatility of the stock raises concerns. Recording a surge of 212% from June to July 2023 inclusive, its value has shown remarkable fluctuations. Given the company's ongoing losses, the level of stock volatility is likely to decrease in the near future, even as the uptrend persists.

Financial status of Xpeng

Since Xpeng Inc. went public on the NYSE on 27 August 2020, it only managed to generate profit during one quarter, while all other reports recorded losses.

Xpeng Inc. released its Q2 2023 report on 18 August. Revenue for April to June decreased by 31.9% from the corresponding period of last year, dropping to 698 million USD, while net loss increased by 3.8%, up to 387 million USD. The margin became negative, reaching −8.6%. Recall that it was 9.1% a year ago.

The number of electric vehicles sold dropped 33% from Q2 2022, down to 23,205 units. If compared with the results of Q1 2023, sales were up by 27.3%. It is worth noting that a negative trend persisted for four consecutive quarters prior to that.

Xpeng’s acquisition of a DiDi Global division

On 28 August, it was announced that Xpeng Inc. would be acquiring DiDi Global Inc.’s vehicle division responsible for the development and manufacturing of electric vehicles. Xpeng Inc.’s management intends to launch a new brand of electric vehicles, with plans to reveal the first model as early as 2024. The companies are also poised to extend cooperation to areas such as marketing, manufacturing of self-driving taxis, and financial and insurance services.

To complete this acquisition, the EV maker will finance the deal by issuing shares worth 744 million USD, following which DiDi Global Inc. will have a 3.25% stake in Xpeng Inc. The ownership stake may increase if the manufacturing and sales targets for new brand electric vehicles are achieved.

Xpeng Inc. stock gained more than 5% on 28 August amid the news of the deal with DiDi Global Inc.

About DiDi Global

DiDi Global Inc. provides taxi, car sharing, food delivery, and cargo transportation services. In addition, the company is engaged in the energy and vehicle manufacturing sector, operating mostly in the Asia-Pacific region and Latin America. In July 2021, DiDi Global Inc. went public on the New York Stock Exchange, but in May 2022, the corporation announced the delisting of its shares from the US trading platform.

What issues did DiDi Global face?

After DiDi Global Inc.’s IPO on the NYSE, the Cyberspace Administration of China (CAC) accused the company of breaching data protection laws and directed the removal of its applications from app stores. Furthermore, the regulator requested the company to provide all the required documents and information about user data security.

This situation had a negative impact on the business and reputation of DiDi Global Inc. As a result, its stock dropped, Q3 2021 loss reached 4.7 billion USD, and revenue decreased by 1.7%. Furthermore, user and partner confidence in the brand was shaken, with competition from other taxi services in China becoming more intense. As mentioned above, the company was delisted from the US exchange in May 2022.

In July 2022, the CAC concluded its investigation into the activities of DiDi Global Inc. and imposed a fine of 1.2 billion USD. The corporation paid the fine and committed to aligning its corporate structure and data management regulations with Chinese laws. Subsequently, its applications were reinstated on the relevant platforms.

Xpeng benefits from DiDi Global takeover

- Introducing a new budget-friendly electric vehicle brand, featuring a model priced at 20,000 USD

- Gaining access to a customer and driver database, which will enable the company to leverage this data for the development of its proprietary AI technologies and autonomous driving system

- Creating conditions for expanding its presence in the Chinese EV market, which is the largest one in the world, and enhancing its competitiveness

- Presenting an opportunity to provide clients with additional services and to introduce its products into the infrastructure of taxi and car-sharing services

Volkswagen’s investment in Xpeng

The partnership with DiDi Global Inc. is not the only important event for Xpeng Inc. in the summer of 2023. On 27 July, the company announced its partnership with Volkswagen AG (XETRA: VOW). The parties aim to develop and launch two new B-class EV models for the Chinese market under the Volkswagen brand.

As per the agreement’s terms, the German automobile manufacturer invested 700 million USD in Xpeng Inc. shares and secured an observer seat on the Board of Directors of the Chinese company.

Xpeng Inc. management expects the partnership with Volkswagen AG to help the corporation cut costs already in 2024 and positively affect its financial performance. The news of the partnership with VAG triggered a 52% surge in the stock value of the Chinese EV manufacturer during three trading sessions.

Conclusion

The summer of 2023 brought two significant events for Xpeng Inc., namely agreements to partner with Volkswagen AG and DiDi Global Inc. These partnerships may create favourable conditions for enhancing the competitiveness of the Chinese EV maker in the local market. This may, in turn, have a positive effect on the volume of electric vehicle sales and revenue of the company. In view of the above, Xpeng Inc. is likely to have prospects for income growth. Technical analysis shows that there are conditions for the potential rise of the quotes.

However, there are also risks that the corporation will not be able to fight off competition. As mentioned above, Xpеng Inc.'s margin became negative in Q2 2023. As a result, the company will lose an opportunity to lower product prices as done by Tesla Inc., which is already well-positioned in the Chinese market. In addition, the company needs to ramp up production, which typically leads to a significant increase in costs.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high